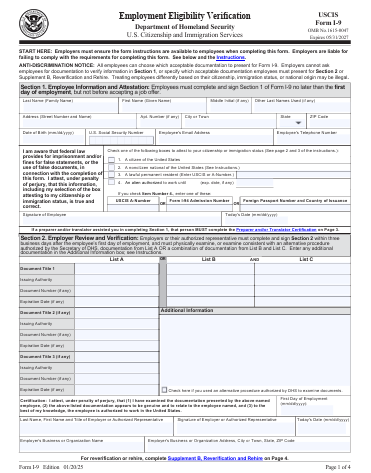

Q1 – Can I ask an employee to show a specific document when completing Form I-9?

No. The employee may choose which document(s) they present from the Lists of Acceptable Documents. You must accept any document (from List A) or combination of documents (one from List B and one from List C) listed on Form I-9 that reasonably appear to be genuine and to relate to the person presenting them.

Q2 – Do I need to complete Form I-9 for independent contractors?

No, independent contractors do not need to complete Form I-9. Form I-9 is used to verify the identity and employment authorization of employees in the United States, and independent contractors are not considered employees for this purpose. Instead, independent contractors typically provide a Form W-9.

Q3 – What is the “I-9, 3-day rule”?

The “I-9, 3-day rule” refers to the requirement for employers to complete Section 2 of the Form I-9, Employment Eligibility Verification, within three business days of a new employee’s first day of work for pay. This rule ensures timely verification of an employee’s identity and work authorization.

Employee’s Role: The employee must complete and sign Section 1 of the I-9 form no later than their first day of employment.

Employer’s Role: The employer (or their authorized representative) must complete Section 2, examining the employee’s documentation and attesting to its validity, within three business days of the employee’s start date.

- For Example – If an employee starts work on Monday, the employer has until Thursday to complete Section 2.

- Even with remote hires, the three-day rule applies to when Section 2 is completed, not when the form comes into the employer’s possession.

Q4 – How long do I have to keep I-9 forms?

I-9 forms should be retained for all current employees. For former employees, federal regulations state they must be retained for one year from the date of termination or three years from the date of the original hire, whichever is later.

Need help navigating? Contact us at [email protected].