The past year has seen significant changes in the employment landscape, presenting both challenges and opportunities for employers. Federal agencies finalized new rules affecting minimum wage, overtime exemptions, pregnancy accommodations, OSHA inspections, and non-compete agreements. Additionally, the Supreme Court’s recent decisions have reshaped administrative law, while state legislatures continue to expand employment laws. State legislatures expanded the patchwork of employment laws on a host of workplace topics.

To help employers navigate this evolving landscape, we will outline four critical labor and employment issues.

1. Labor Force Participation for Prime-Age Workers Continues to Increase, Yet Worker Shortages Remain

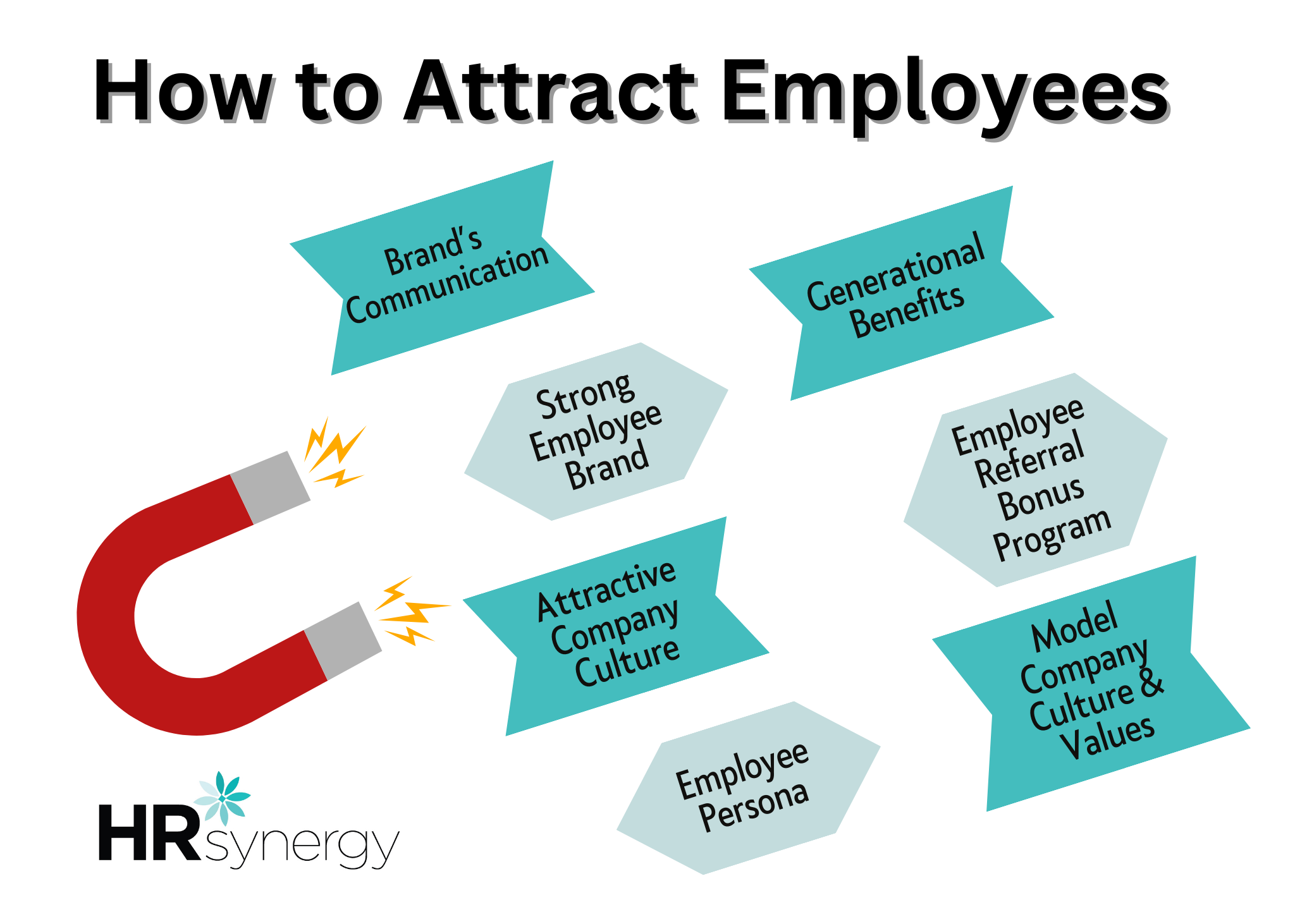

Despite an increase in labor force participation among “prime age” workers (ages 25 to 54), employers still face challenges filling open positions. According to the U.S. Chamber of Commerce, around 1.7 million workers are missing from the post-pandemic workforce. Post-pandemic shifts in work preferences, such as a desire for remote or flexible work, have left many sectors understaffed. Also, many older workers retired during the pandemic. Skilled labor shortages and immigration challenges exacerbate the issue, leaving businesses struggling to find qualified talent.

2. AI is Accelerating Workforce Transformation

AI is transforming the workforce, automating routine tasks, and reshaping job roles across industries. Job fields including AI ethics, machine learning, and data science allow for new career opportunities. While AI brings efficiencies, it also raises concerns about job displacement and increased surveillance. Regulatory oversight is increasing as federal and state governments aim to protect workers’ rights, the administration has issued executive orders to ensure responsible AI development, including the Algorithmic Accountability Act.

3. The U.S. Supreme Court is Upending Administrative Law

Recent Supreme Court rulings have limited federal agencies’ rule-making authority, increasing uncertainty for employers. These decisions could have far-reaching implications for labor and employment law, making it harder for agencies to enforce new regulations and creating a more complex legal environment for businesses.

4. Immigration Challenges Continue to Impact Hiring

Immigration reforms, including changes to H-1B for “highly educated” foreign workers in “specialty occupations” and H-2B for temporary non-agricultural workers visa programs, are affecting employers’ ability to hire foreign workers. Currently, the final part of H-1B Modernization Rule is set to be published in December 2024 and will clarify the regulatory definition of “speciality occupation” and give an added burden of establishing a “direct relationship” between the required degree and the duties to be performed for the employer. Stricter visa caps and regulatory delays on H-2B visas are creating additional hurdles, particularly for industries relying on seasonal labor. The Department of Homeland Security published a Notice of Proposed Rule-Making (NPRM) in 2023 to modernize the program with flexibility and protections for workers. The final rule is set to be published by April 2025. The U.S. Department of State is expanding its pilot program for state-side visa renewals, allowing certain visa holders to renew within the U.S., reducing the need for international travel. This will help employers avoid disruptions and reduce delays for employees re-entering the country. Businesses must navigate these challenges to maintain their workforce.

As businesses adapt to these changes, it’s crucial to stay informed and proactive. Employers must be prepared to address labor shortages, leverage AI responsibly, and understand the legal landscape to remain competitive in the evolving world of work.

Support for middle managers is crucial. Granting middle managers more decision-making power can alleviate stress and enhance job satisfaction. Enhancing their authority and influence, providing necessary resources, and restructuring their role as leadership-focused can alleviate some stress. Additionally, improving the relationship between HR and middle managers is essential. HR must actively listen to middle managers, seeking and valuing their feedback to understand their unique challenges. Regular check-ins and open communication channels create a psychologically safe environment. HR should validate managers’ experiences and provide training on managing hybrid environments, ensuring middle managers feel supported and heard.

Support for middle managers is crucial. Granting middle managers more decision-making power can alleviate stress and enhance job satisfaction. Enhancing their authority and influence, providing necessary resources, and restructuring their role as leadership-focused can alleviate some stress. Additionally, improving the relationship between HR and middle managers is essential. HR must actively listen to middle managers, seeking and valuing their feedback to understand their unique challenges. Regular check-ins and open communication channels create a psychologically safe environment. HR should validate managers’ experiences and provide training on managing hybrid environments, ensuring middle managers feel supported and heard.

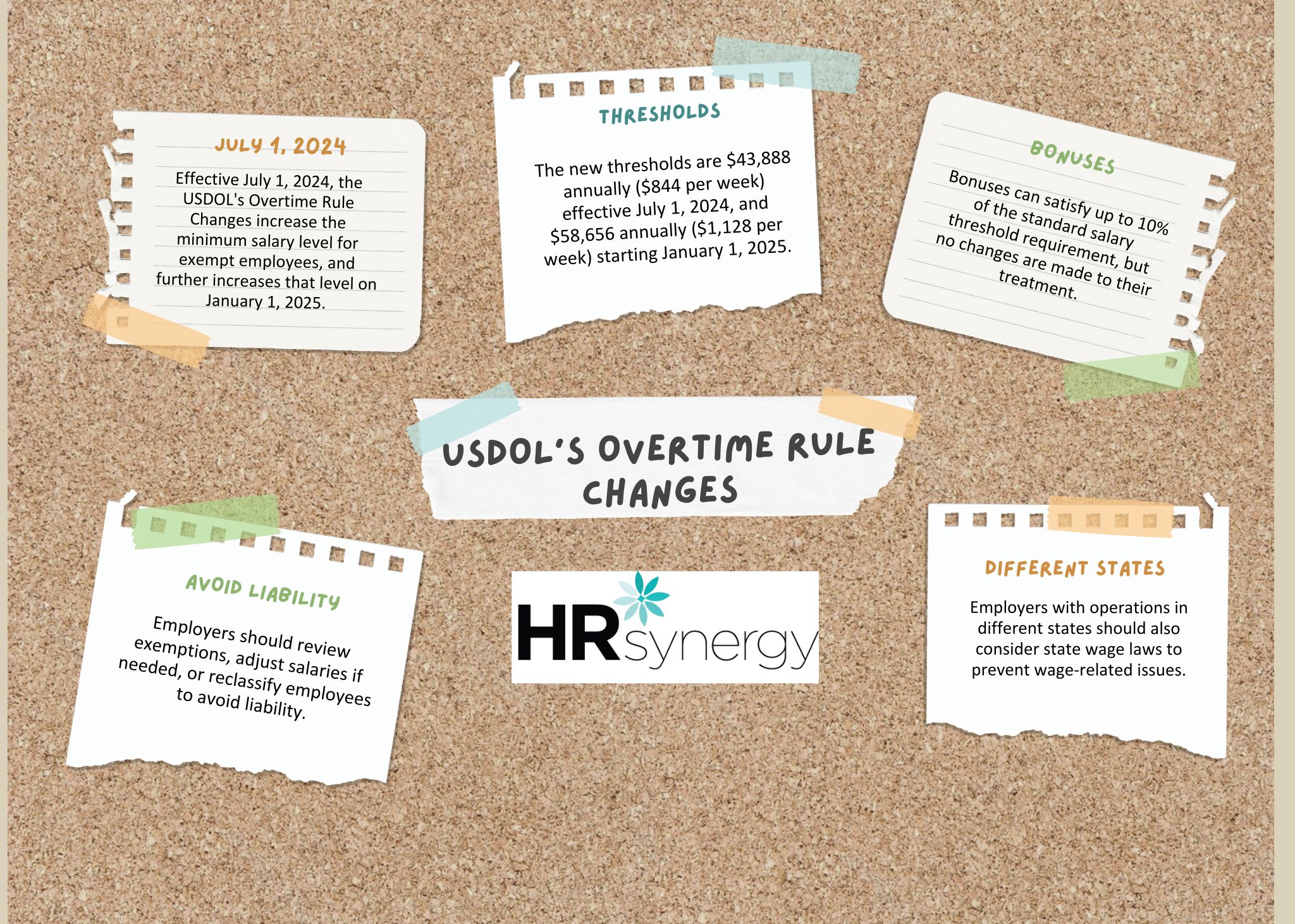

On April 23, 2024, the USDOL issued a Final Rule that will raise the minimum salary level for exempt employees and increase the total compensation minimum for highly compensated employees (HCEs). The new rule also introduces a mechanism to update these thresholds every three years. Despite potential legal challenges that may delay implementation, employers should review and adjust current salaries to ensure compliance with the new minimums.

On April 23, 2024, the USDOL issued a Final Rule that will raise the minimum salary level for exempt employees and increase the total compensation minimum for highly compensated employees (HCEs). The new rule also introduces a mechanism to update these thresholds every three years. Despite potential legal challenges that may delay implementation, employers should review and adjust current salaries to ensure compliance with the new minimums.