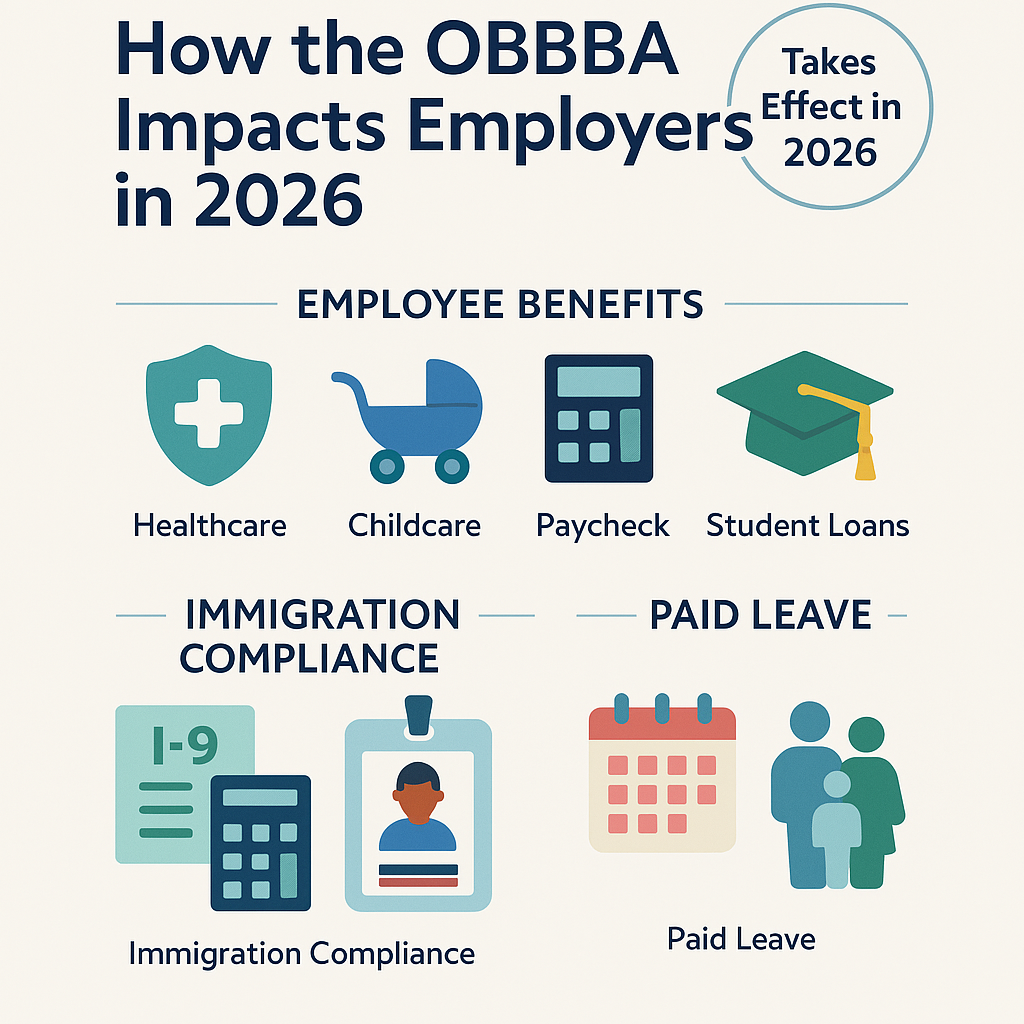

After months of debate and revisions, the One Big Beautiful Bill Act (OBBBA) was signed into law by President Donald Trump on July 4, 2025. While the bill introduces sweeping changes for individuals, it also brings significant implications for employers—especially in the areas of benefits, payroll, taxes, immigration compliance, and paid leave.

Are you wondering how these changes will affect your organization? Here’s what you need to know to start preparing for 2026.

Key Changes to Employee Benefits

Health Savings Accounts (HSAs)

Telehealth services can now be offered before the deductible is met for employees with high-deductible health plans—making a pandemic-era provision permanent.

Dependent Care FSAs

The annual pre-tax contribution limit increases from $5,000 to $7,500. The employer-provided childcare credit also rises significantly, with small businesses eligible for up to $600,000 in credits.

Fringe Benefits

- Moving expense reimbursements are now taxable.

- Student loan discharges due to death or disability remain tax-exempt.

Payroll and Tax Implications

Overtime Pay Deduction

Employers can deduct up to $12,500 in overtime pay, with a phase-out for high earners. This must be reported separately on Form W-2.

Service Tips

Employees may deduct up to $25,000 in qualifying tips, excluding mandatory service charges.

Independent Contractor Reporting

The Form 1099 threshold increases from $600 to $2,000, reducing administrative burden but requiring payroll system updates.

Other Notable Provisions

- Student Loan Repayment: Employer contributions up to $5,250 remain tax-free.

- Meal Deduction Eliminated, but bike commuting reimbursements stay deductible.

- Adoption Credit: Now includes a refundable portion up to $5,000.

Immigration Compliance

The OBBBA allocates funding for 10,000 new ICE agents and expands the 287(g) program, increasing the likelihood of I-9 audits. Employers should ensure all documentation is accurate and compliant.

Paid Family and Medical Leave

The employer credit for paid leave continues, with greater flexibility in how it’s calculated—either based on wages paid or insurance premiums. Employees with six months of tenure may now qualify.

Stay Ahead of the Curve

The OBBBA introduces complex changes that will reshape how employers manage HR and compliance. Staying informed and proactive is key.

HR Synergy is here to help. Our team of consultants keeps you up to date with legislative changes and provides the tools you need to adapt with confidence.