As 2025 winds down, employers across New England face a wave of new HR and compliance changes. From paid leave to pay transparency and wage increases, here is a quick Q&A guide to keep your team ready for 2026.

Building on our previous national overview, here’s what HR teams across New England need to know before January 1.

What’s the biggest HR change for New England in 2026?

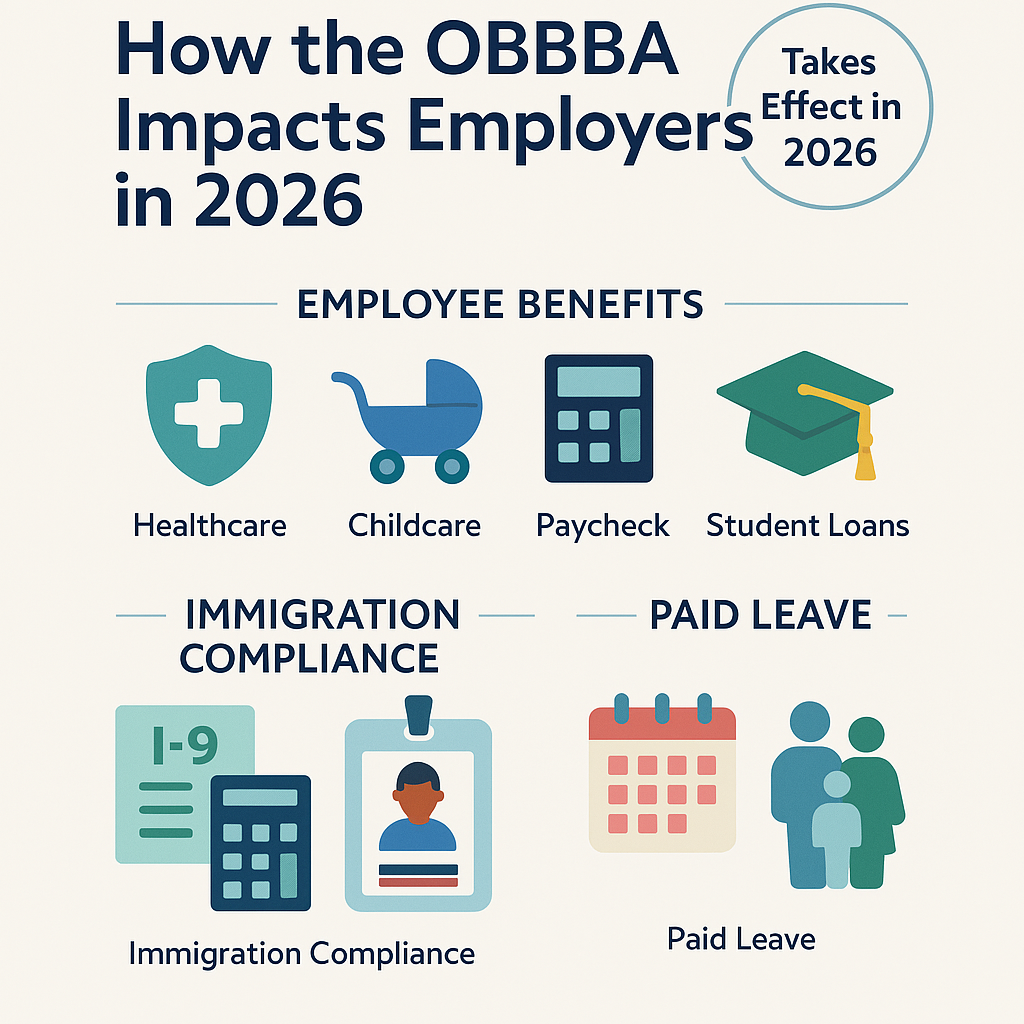

Maine’s Paid Family and Medical Leave (PFML) program launches May 1, 2026, offering up to 12 weeks of paid leave for family or medical reasons. Payroll contributions started January 1, 2025, so setup should begin now.

✅ Checklist:

- Register with Maine’s PFML portal and update payroll systems.

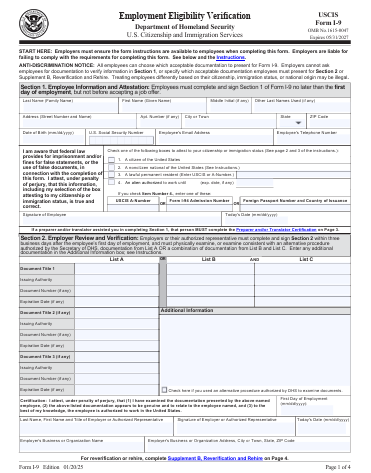

- Add PFML details to your handbook and onboarding materials.

- Post required state notices once released.

What’s New in Massachusetts?

Starting October 29, 2025, employers with 25+ employees must include pay ranges in all job postings. Those with 100+ employees must file annual pay data reports beginning in 2026.

✅ Checklist:

- Audit job postings for salary range compliance.

- Train hiring teams on disclosure requirements.

- Conduct internal pay equity reviews.

What’s Changing in Connecticut and Other Nearby States?

Connecticut’s expanded Paid Sick Leave Law takes effect January 1, 2026, covering more employers and reasons for time off. Vermont has updated its family leave rules, and Rhode Island continues expanding Temporary Caregiver Insurance coverage.

✅ Checklist:

- Update sick and family leave policies.

- Ensure time-off tracking systems reflect multi-state rules.

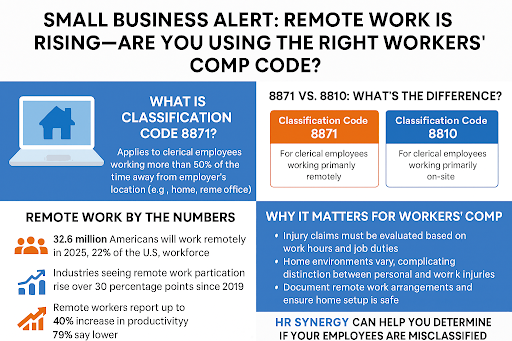

- Review remote work policies for cross-state employees.

Do We Need to Adjust Payroll for 2026?

Yes. All six New England states are raising minimum wages on January 1, 2026, and several are reviewing overtime eligibility thresholds.

✅ Checklist:

- Verify new wage rates for each state.

- Review exempt vs. nonexempt classifications.

- Update pay statements and offer letters.

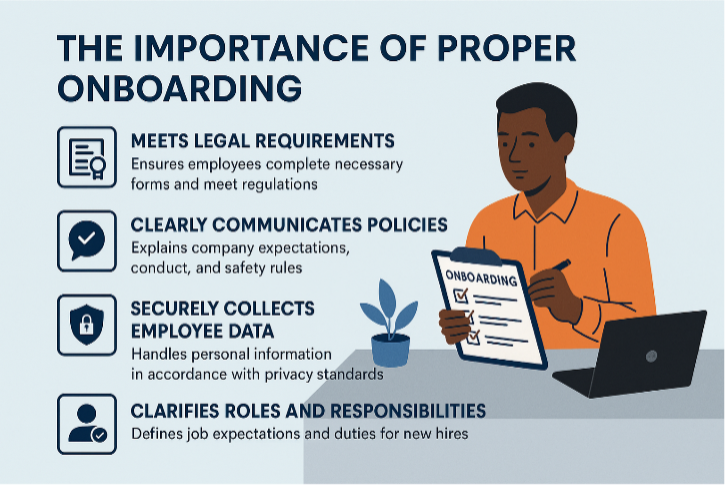

What Else Should HR Keep an Eye On?

Expect updates to mandatory workplace postings, emerging AI and hiring transparency laws, and growing data privacy requirements for employee information.

✅ Checklist:

- Order new 2026 labor law posters.

- Review vendor compliance with AI and privacy rules.

- Schedule HR compliance training for Q1 2026.

Start 2026 with a clear compliance checklist, from handbook updates to pay transparency, leave laws, and payroll adjustments. Make sure your HR team is proactive, not reactive, in the new year.

Reach out to us at [email protected] to learn more.