Reach out to us at HR Synergy with Questions.

New Form I-9 Released: What Employers Need to Know (But Don’t Need to Do Yet)

On April 2, 2025, USCIS released an updated Form I-9, introducing minor terminology changes:

- “Noncitizen” is now “alien”

- “Gender” is now “sex”

- The form now shows a 1/20/25 edition date

Instructions and DHS Privacy Notice were also updated, with changes reflected in E-Verify and E-Verify+ starting April 3, 2025.

Use of the new form is optional. Employers may continue using the 8/1/23 versions, which remain valid until 2026 or 2027. However, those using E-Verify should be aware of the updated terminology when matching employee information. Updated Form I-9.

EEOC and Justice Department Warn Against Unlawful DEI-Related Discrimination

March 19, 2025: Employers’ DEI Policies, Programs, and Practices Can Violate Title VII of the Civil Rights Act of 1964. Read more.

PFML Compliance Requirements for Massachusetts Employers

All Massachusetts employers, including those with private or self-insured benefits plans, must provide specific information to their employees in compliance with the Paid Family and Medical Leave (PFML) law.

Poster Requirement

2025 PFML mandatory workplace poster

- All Massachusetts employers must display a PFML workplace poster in a visible location.

- The poster must be available in English and any language spoken by five or more employees.

Employee and Self-Employed Notices

- For 25 or more covered individuals:

- Employers must distribute a notice informing employees and self-employed individuals of their PFML rights and obligations.

- 2025 Employer Notice for a workforce with 25 or more covered individuals

- For fewer than 25 covered individuals:

- A similar notice must be provided with relevant obligations.

- 2025 Employer Notice for a workforce with fewer than 25 covered individuals

- For self-employed individuals:

- Employers must provide notices for self-employed individuals, categorized by workforce size (more or fewer than 25).

- 2025 Notice to Self Employed Individuals from Employers with More Than 25 Covered Individuals

- 2025 Notice to Self Employed Individuals from Employers with fewer than 25 Covered Individuals

- Notices must be available in English and other applicable languages, with DFML providing translations in 12 languages.

Rate Sheets

- Employers must submit PFML contributions for all employees.

- Contribution rates apply for 2025.

2025 Rate sheet for employers with 25 or more covered individuals

2025 Rate sheet for employers with less than 25 covered individuals

Compliance Tips for Avoiding Common FMLA Violations

Navigating the Family and Medical Leave Act (FMLA) can be complex, especially when handling intermittent or reduced-schedule leaves.

Employers frequently make mistakes that lead to compliance violations:

- Failing to provide required notices

- Improperly tracking absences

- Penalizing employees for FMLA-protected leave

- Requesting excessive medical documentation

Many of these errors stem from inadequate manager training and failure to recognize FMLA-qualifying leave requests.

Key Compliance Strategies:

- Understand FMLA Regulations – Employers should thoroughly review FMLA guidelines and post required notices.

- Post the FMLA poster – Download the poster from the U.S. Department of Labor (DOL) Wage and Hour Division website.

- Create the required FMLA forms – These forms include eligibility notice, rights and responsibilities notice, designation, medical and military certification forms. The forms from the DOL Wage and Hour Division can be customized with restrictions.

- Develop a Clear Policy – A well-defined company policy should outline FMLA administration, including leave calculation methods and responsible personnel.

- Process requests – Process in compliance with FMLA regulations, relevant laws, and company policies.

- Train Managers Regularly – Supervisors should be educated on how to handle FMLA leave requests, recognize protected absences, and avoid retaliation.

Employers who implement structured FMLA procedures and provide ongoing training can minimize compliance risks while fostering a supportive workplace.

New Hampshire Adopts Workplace Accommodations for Nursing Mothers

Effective Date: New Hampshire’s new law begins July 1, 2025.

Effective Date: New Hampshire’s new law begins July 1, 2025.- Break Entitlement: Nursing mothers are guaranteed a 30-minute unpaid break every three hours to express breast milk.

- Alignment with Federal PUMP Act (2022):

- Requires reasonable break times and clean, private spaces (not bathrooms) for expressing milk for one year after childbirth.

- Employers in New Hampshire must comply with both state and federal regulations.

- Employer Applicability:

- Applies to employers with at least six employees in New Hampshire.

- Employers must adopt and provide lactation accommodation policies to employees upon hire.

- Employee Requirements:

- Employees must give at least two weeks’ notice before requesting breaks and lactation spaces.

- Breaks can align with existing meal or rest periods.

- Space Requirements:

- Must be clean, shielded from view, and free from intrusion.

- Cannot be a bathroom and should be within a reasonable walking distance unless otherwise agreed.

- Flexibility and Negotiation:

- Employers and employees can negotiate alternative break arrangements.

- Employees are not required to make up time for break periods.

- Exemptions for Employers:

- Applies only if accommodating breaks or providing space causes “undue hardship.”

- Defined by significant difficulty or expense relative to the employer’s size, resources, and operations.

- Action for Employers:

- Review obligations under both the federal PUMP Act and New Hampshire’s new law.

- Implement compliant policies and ensure proper accommodations are in place.

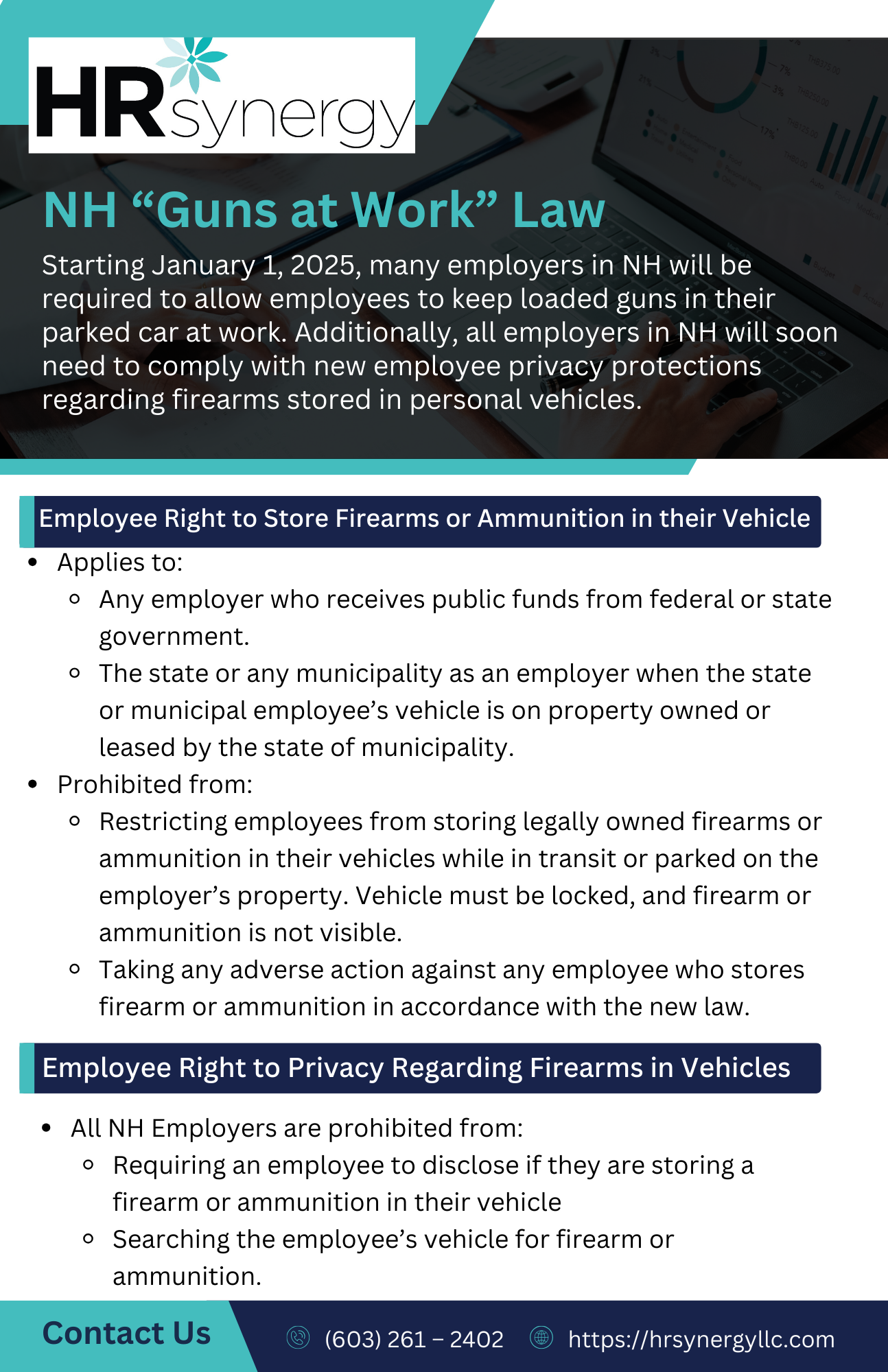

NH “Guns at Work” Law

Many employers in NH will be required to allow employees to keep loaded guns in their parked car at work. Additionally, all employers in NH will soon need to comply with new employee privacy protections regarding firearms stored in personal vehicles. See attached for more information and don’t hesitate to contact us with any questions you may have.

Many employers in NH will be required to allow employees to keep loaded guns in their parked car at work. Additionally, all employers in NH will soon need to comply with new employee privacy protections regarding firearms stored in personal vehicles. See attached for more information and don’t hesitate to contact us with any questions you may have.

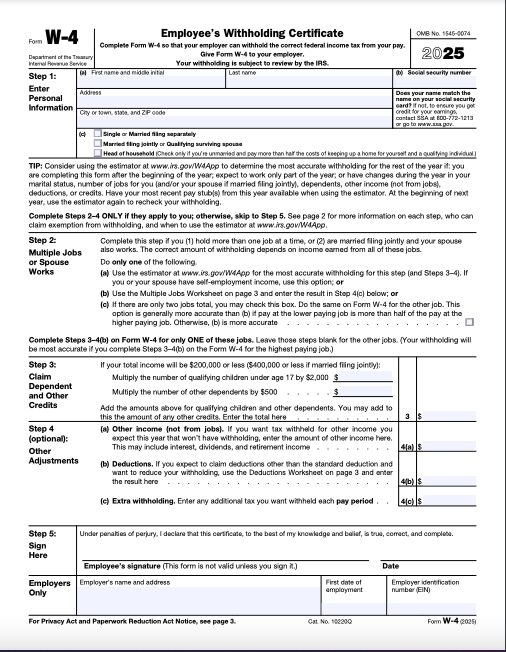

W4 2025 Update

As we begin the new year, please be informed that the 2025 W-4 form is now available. All employees hired on or after January 1, 2025, as well as those wishing to make changes to their federal withholdings, must complete this form.

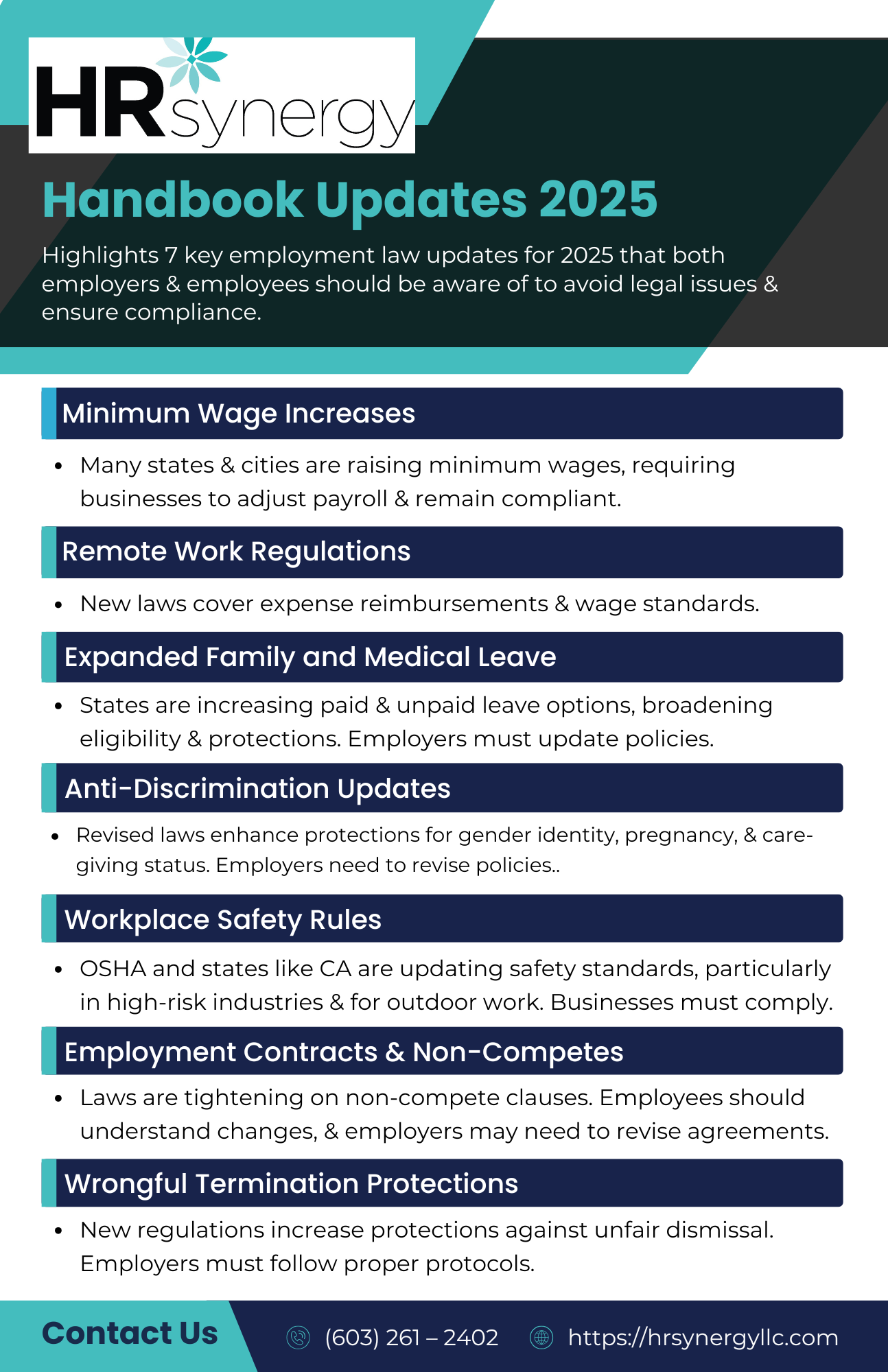

2025: HANDBOOK Employment law updates

Highlights seven key employment law updates for 2025 that both employers and employees should be aware of in order to avoid legal issues and ensure compliance.

Highlights seven key employment law updates for 2025 that both employers and employees should be aware of in order to avoid legal issues and ensure compliance.

1. Minimum Wage Increases: Many states and cities are raising minimum wages in 2024, requiring businesses to adjust payroll and remain compliant. Employees should monitor their pay to ensure proper compensation.

2. Remote Work Regulations: New laws cover expense reimbursements and wage standards for remote workers, with states like California ensuring compensation for work-related expenses.

3. Expanded Family and Medical Leave: States are increasing paid and unpaid leave options, broadening eligibility and protections. Employers must update policies, and workers should know their expanded rights.

4. Anti-Discrimination Updates: Revised laws in various states enhance protections for gender identity, pregnancy, and caregiving status. Employers need to revise policies, and employees should understand their rights.

5. Workplace Safety Rules: OSHA and states like California are updating safety standards, particularly in high-risk industries and for outdoor work. Businesses must comply to avoid penalties.

6. Employment Contracts & Non-Competes: Laws are tightening on non-compete clauses, especially for lower-wage workers. Employees should understand these changes, and employers may need to revise agreements.

7. Protections: New regulations in 2025 increase protections against unfair dismissal. Employers must follow proper protocols, while employees should seek legal advice if terminated unjustly.

Understanding 2025 employment law updates is critical for businesses to stay compliant and for employees to safeguard their rights. Employers must stay updated on these changes to avoid legal consequences, while employees should understand their rights to ensure fair treatment in the workplace.

2025 UPDATES: Massachusetts PFML

Massachusetts employers need to inform their employees about the 2025 Paid Family and Medical Leave (PFML) contribution rates by December 2, 2024.

The 2025 rates are:

- 0.88% for employers with 25 or more employees.

- 0.46% for employers with fewer than 25 employees.

Employers must distribute Rate Sheets showing the contribution shares for both the employer and employees. These notices can be given out like other policy updates, and while no signed acknowledgment is needed, it’s good to have proof of distribution.

Additionally, an updated PFML poster with the 2025 maximum weekly benefit amount of $1,170.64 must be displayed prominently.

For new employees, revised notices must be issued within 30 days of hire, and employees should acknowledge receipt.

The updated notice should include:

- The new maximum benefit amount.

- Information on using accrued paid leave to supplement PFML benefits.

- A requirement that PTO policies do not discriminate against employees using PFML.

Employers should review and clarify their paid time off policies, especially if they offer unlimited time off, to specify limits during PFML leave.

The Department of Family and Medical Leave (DFML) will continue audits, with fines of:

- $50 per employee for a first notice violation and;

- $300 for subsequent violations.

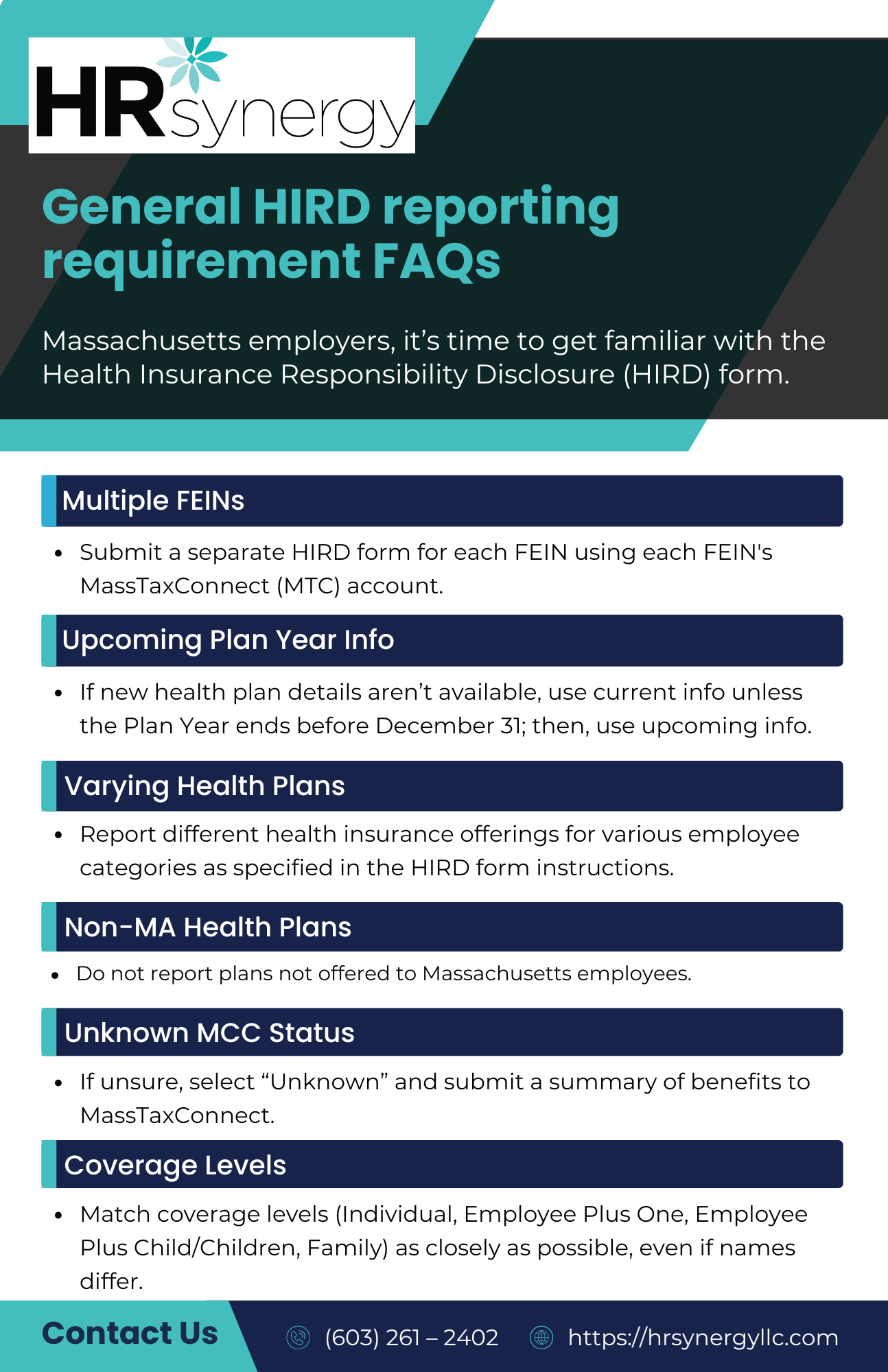

BY 12/15/24: General HIRD reporting requirements

Massachusetts employers, it’s time to get familiar with the Health Insurance Responsibility Disclosure (HIRD) form. This annual requirement, launched in 2018, helps MassHealth identify members who might qualify for the Premium Assistance Program by gathering information about employer-sponsored insurance (ESI) offerings. Here’s a quick breakdown to keep you compliant.

Massachusetts employers, it’s time to get familiar with the Health Insurance Responsibility Disclosure (HIRD) form. This annual requirement, launched in 2018, helps MassHealth identify members who might qualify for the Premium Assistance Program by gathering information about employer-sponsored insurance (ESI) offerings. Here’s a quick breakdown to keep you compliant.

HIRD Form Purpose: Annual reporting requirement for Massachusetts employers to provide information on employer-sponsored insurance (ESI) offerings, aiding MassHealth’s Premium Assistance Program.

Who Must File: Employers with six or more employees in Massachusetts, even if health insurance isn’t offered.

Filing Period: November 15 to December 15, completed electronically via MassTaxConnect (no paper forms).

Responsibility: Employers must ensure timely filing, even if using a payroll company or PEO. Coordination with HR/benefits is necessary.

Data Collected: Employer-level health plan information only, no personal employee data.

Non-Compliance Impact: No new penalties, but important for MassHealth assistance programs and won’t affect EMAC Supplement obligations.

Action Required for Non-Offering Employers: Still required to submit, indicating no health insurance is provided.

December 2024: How Should Employers Respond Now that OVERTIME RULE Is Blocked?

A Federal court decision on November 15 blocked planned increases to the salary threshold for overtime exemptions.

The salary threshold will return to the 2019 level of $35,568 annually ($684.00 per week), halting increases scheduled for July 2024 ($43,880) and January 2025 ($58,656).

The court criticized the increases for exceeding statutory authority and prioritizing salary thresholds over the duties test. The ruling applies nationwide and nullifies automatic salary threshold adjustments.

- Employers who increased salaries in preparation for the new rule are unlikely to lower them. However, some employees who were reclassified as nonexempt might be switched back to exempt if they fulfill the duties test.

- The duties test remains a key determinant for white-collar exemptions, requiring assessment of job roles alongside salary.

- The ruling may be appealed, and changes could occur under the incoming presidential administration.

- Employers must assess workforce impacts and comply with duties tests and state notice requirements when reclassifying employees.

- Duties tests outline specific criteria for executive, administrative, and professional exemptions, ensuring roles meet both duties and salary standards.

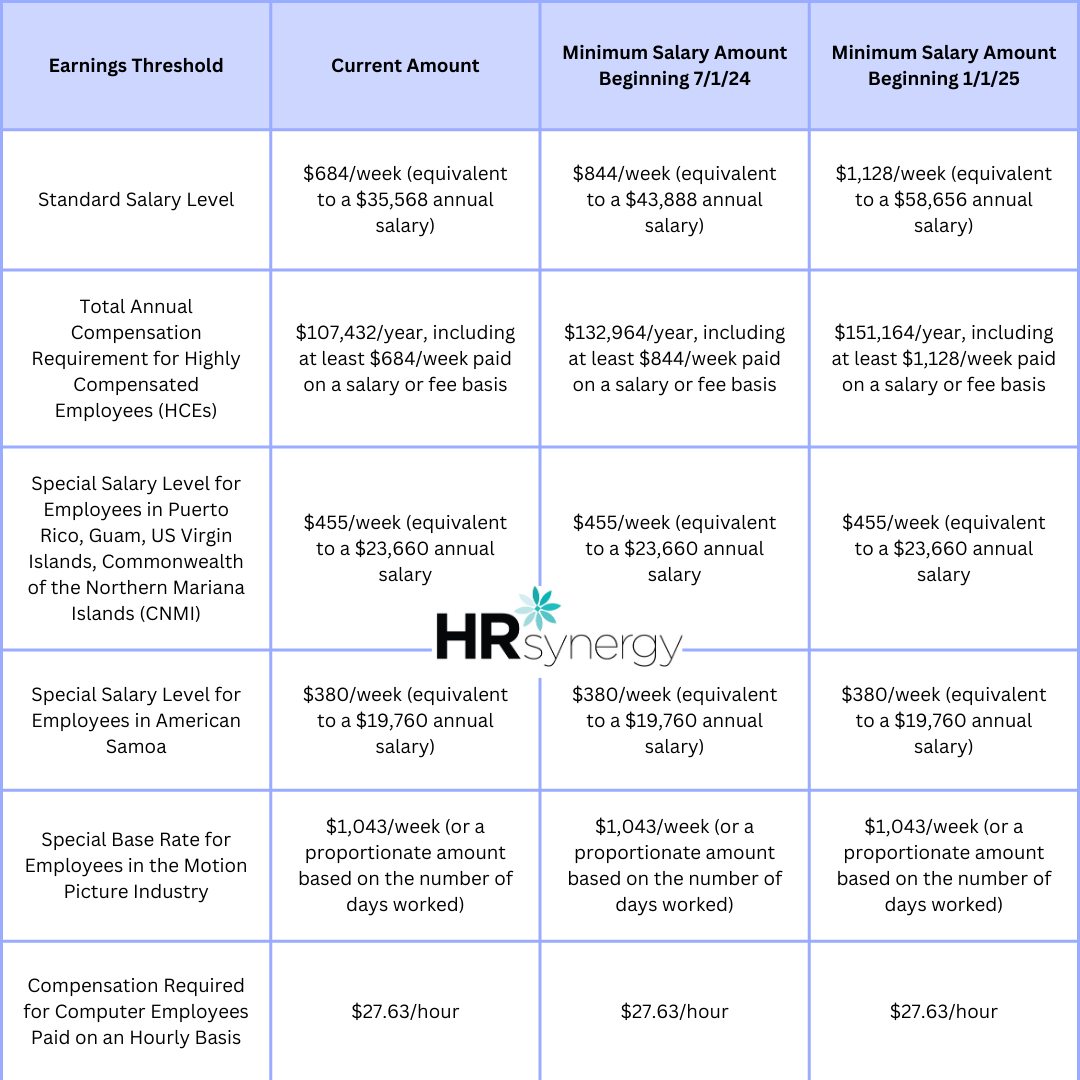

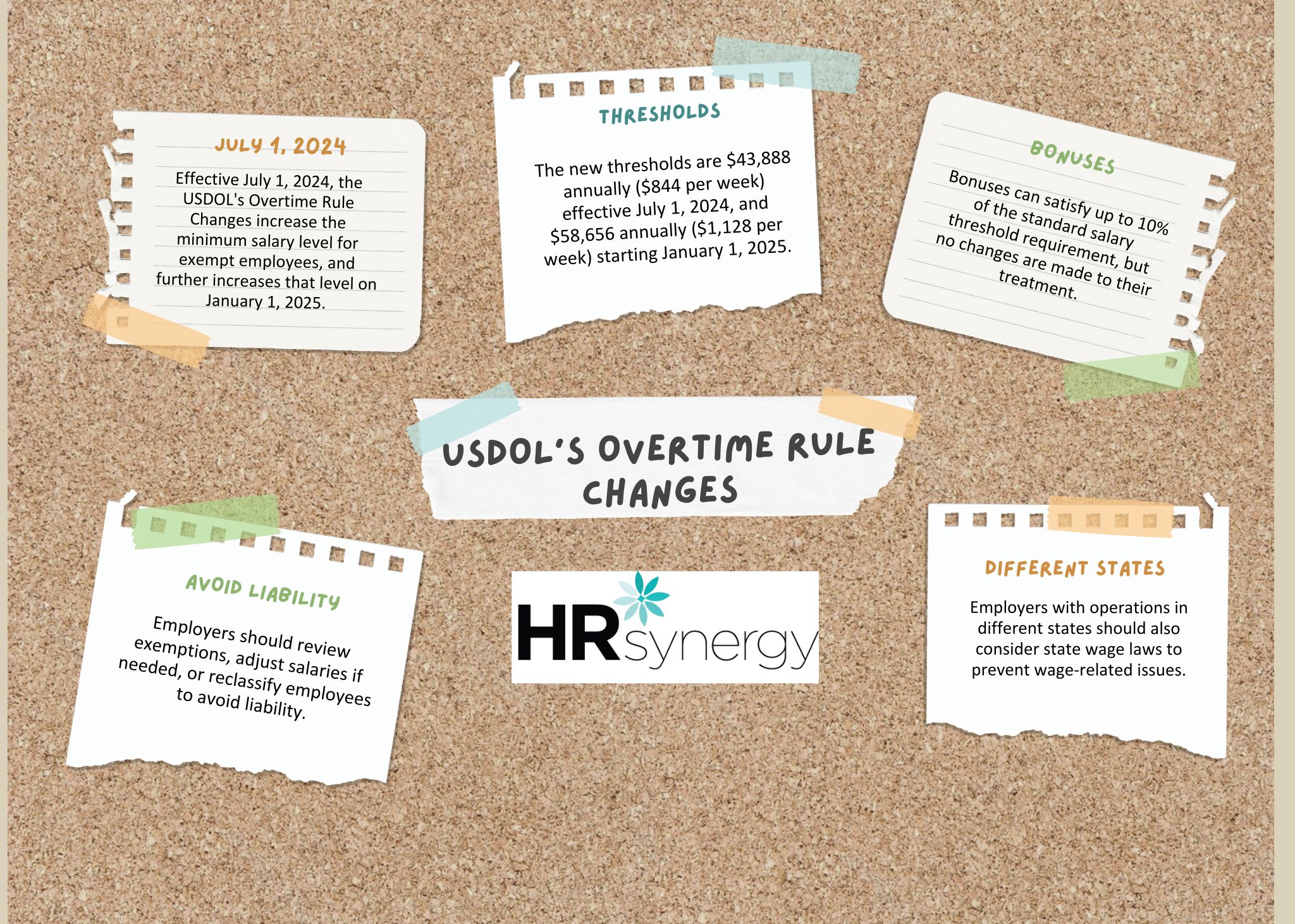

APRIL 23, 2024: OVERTIME RULE

On April 23, 2024, the USDOL issued a Final Rule that will raise the minimum salary level for exempt employees and increase the total compensation minimum for highly compensated employees (HCEs). The new rule also introduces a mechanism to update these thresholds every three years. Despite potential legal challenges that may delay implementation, employers should review and adjust current salaries to ensure compliance with the new minimums.

On April 23, 2024, the USDOL issued a Final Rule that will raise the minimum salary level for exempt employees and increase the total compensation minimum for highly compensated employees (HCEs). The new rule also introduces a mechanism to update these thresholds every three years. Despite potential legal challenges that may delay implementation, employers should review and adjust current salaries to ensure compliance with the new minimums.

The rule’s journey began in Fall 2023 when the USDOL proposed changes to the federal wage law overtime exemption requirements. These proposed changes were open for public comment until November 8, 2023. During the comment period, concerns were raised about the substantial 65% increase and its impact on businesses during a tough economic period. To ease the transition, the USDOL adopted a two-step compliance approach, raising salary thresholds on July 1, 2024, and January 1, 2025.

The USDOL estimates that about 1 million currently exempt workers earn below the new $43,888 threshold and another 3 million earn less than $58,656. Employers must either raise salaries to meet the new minimum levels or reclassify these employees as non-exempt and eligible for overtime pay. While legal challenges are anticipated, similar to those in 2016, the outcome is uncertain. Therefore, employers should review current exemptions to avoid potential misclassification liabilities.

Employers should ensure exempt employees are paid at least the current minimum salary and that their job duties align with the exempt categories. For those who do not meet the duties test or new salary levels, employers need to confirm work schedules, communicate overtime eligibility, and review timekeeping, meal break, and overtime approval policies. Additionally, managers and supervisors should be trained on monitoring work hours and timekeeping.

Employers operating in multiple states should also consider varying state wage laws, which may have higher minimum salaries for overtime-exempt employees, to avoid unfavorable wage audits or claims. Compliance with both the FLSA Final Rule and state laws is crucial for reducing legal risks.