Do your employees feel like their salaries aren’t keeping up with the climb of inflation as their personal financial stressors of housing, groceries, gas, and medical costs increase? 80% of 1,100 employees surveyed this October feel this way according to Remote.co, a remote-work resource. Fortunately, the Consumer Price Index (CPI) only rose 7.1% for the 12 months ending in November, compared to 9.1% year-over-year high for the period ending in June. Employers are concerned about economic uncertainty, the threatening recession, and shifting employee needs.

Be aware that your employees may feel pressure with their career choices, causing 47% of them to look for higher-paying jobs and 31% taking a side job for extra cash.

For the past few years, HR and employers agree with being transparent with employees in regard to pay. HR Synergy offers tools that can help ease your burden with the challenge of navigating a tight labor market amid a shifting global economy.

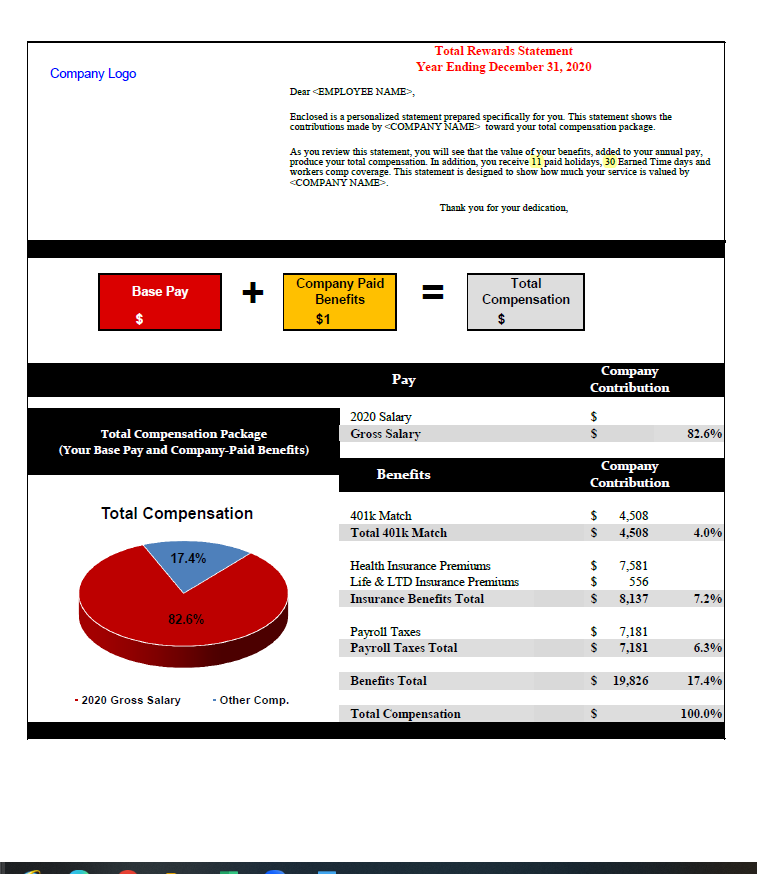

To assist with educating employees about the direct and indirect costs paid by their employer, we work with clients to prepare a total compensation letter (“hidden paycheck”) at the end of the year; for all employees. See the example below. Do you want your employees to truly understand what their compensation consists of beyond salary?

Employees are feeling the pressure with the financial choices they need to make. 45% tightened their budget and 23% are putting more money towards an emergency fund. Nearly half of employees surveyed were hesitant to contribute as much as they previously did to their consumer-driven health (CDH) accounts (health savings accounts (HSAs) and flexible spending accounts (FSAs)). Compared to CDH contributions during the pandemic where almost ¾ of employees did not make adjustments. HR Synergy can help counsel how using CDH accounts and paying for things with pre-tax dollars can save your employees money. Billions in tax savings are left on the table. Let us help you help your employees shift their thinking from short-term expenses to long-term investments. We can clearly show how using pre-tax dollars can save them money.

Employers are already increasing salaries an average of 4.6% in 2023 (vs. 4.2% in 2022) in response to inflation and the employee-driven job market. 63% of executives intend to increase compensation adjustments due to inflation this year according to the consulting firm Gartner. Consider making the salary increases through two adjustments throughout the year. Employees do not want to perpetuate the vicious cycle of increased wages causing the price of products and services to increase. Contact HR Synergy today to help you complete a market analysis for your jobs to determine pay increases based on market competitiveness.

These are volatile times. There are other steps besides increasing salaries or giving bonuses to counter inflation felt by employees. Focus on a supportive company culture and retention of quality employees. You can offer fair pay, flexible work options, career development opportunities, promote from within, provide competitive (financial wellness) benefits, and give regular feedback. Lastly, intentionally show employees your appreciation to give them a feeling of job security and foster loyalty.

Click here to contact us for help regarding employee retention and more information on a total compensation letter.