Category: Uncategorized

Recent Employer Communications

Check out our recent blogs:

- 2026 HR & Business Compliance: What You Need to Know

- The Massachusetts Pay Transparency Law

- Why Onboarding Matters for Small Businesses and Nonprofits — And the Risks of Skipping Documentation

- I-9 Basics

- Understanding Workers’ Comp Codes for Remote Employees: What Small Businesses Need to Know

- Resolve Wage & Hour Issues Without the Headache: How Small Businesses Can Benefit from the PAID Program

- Breaking Down the Big Beautiful Bill: What Employers Must Know for 2026 and Beyond

- Hiring Across State Lines? Here’s What You Need to Know

- How HR Synergy Makes PCOR Filing Easy

- Navigating Labor Laws Without an HR Team

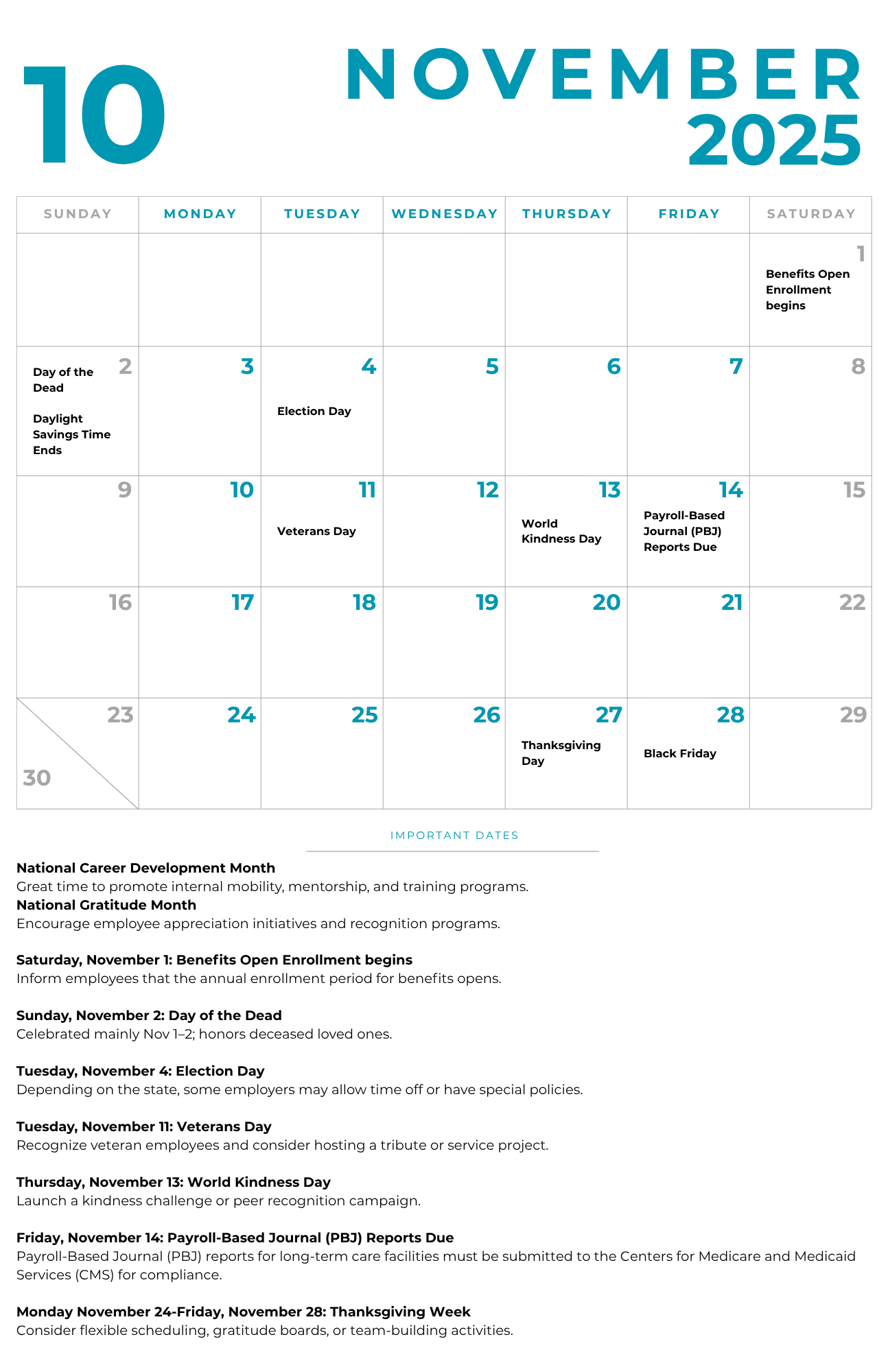

October 2025 Calendar

Recent Employer Communications

Check out our recent blogs:

- I-9 Basics

- Understanding Workers’ Comp Codes for Remote Employees: What Small Businesses Need to Know

- Resolve Wage & Hour Issues Without the Headache: How Small Businesses Can Benefit from the PAID Program

- Breaking Down the Big Beautiful Bill: What Employers Must Know for 2026 and Beyond

- Hiring Across State Lines? Here’s What You Need to Know

- How HR Synergy Makes PCOR Filing Easy

- Navigating Labor Laws Without an HR Team

- Workplace Safety Manuals & Training

- Creating a Healthy & Safe Workplace: Prioritizing Wellness and Safety in June

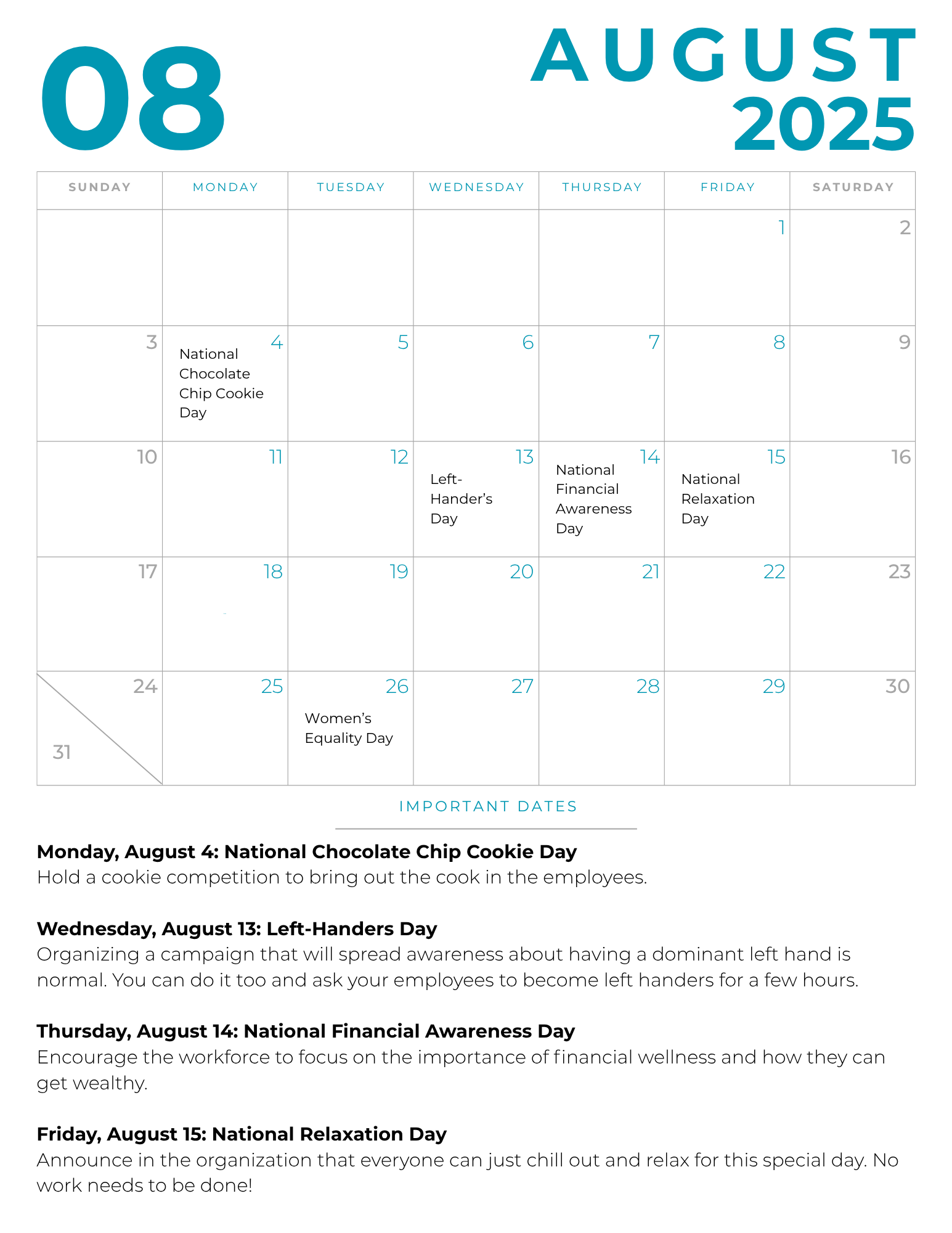

Recent Employer Communications

Check out our recent blogs:

- Breaking Down the Big Beautiful Bill: What Employers Must Know for 2026 and Beyond

- Hiring Across State Lines? Here’s What You Need to Know

- How HR Synergy Makes PCOR Filing Easy

- Navigating Labor Laws Without an HR Team

- Workplace Safety Manuals & Training

- Creating a Healthy & Safe Workplace: Prioritizing Wellness and Safety in June

- Mental Health, HR, and the Workplace: Bridging the Gap Between Intentions and Impact

- Reporting to Work Pay: What Employers and Employees Need to Know

- New Form I-9 Released: What Employers Need to Know (But Don’t Need to Do Yet)

- 2025 NH Workplace Accommodations for Nursing Mothers

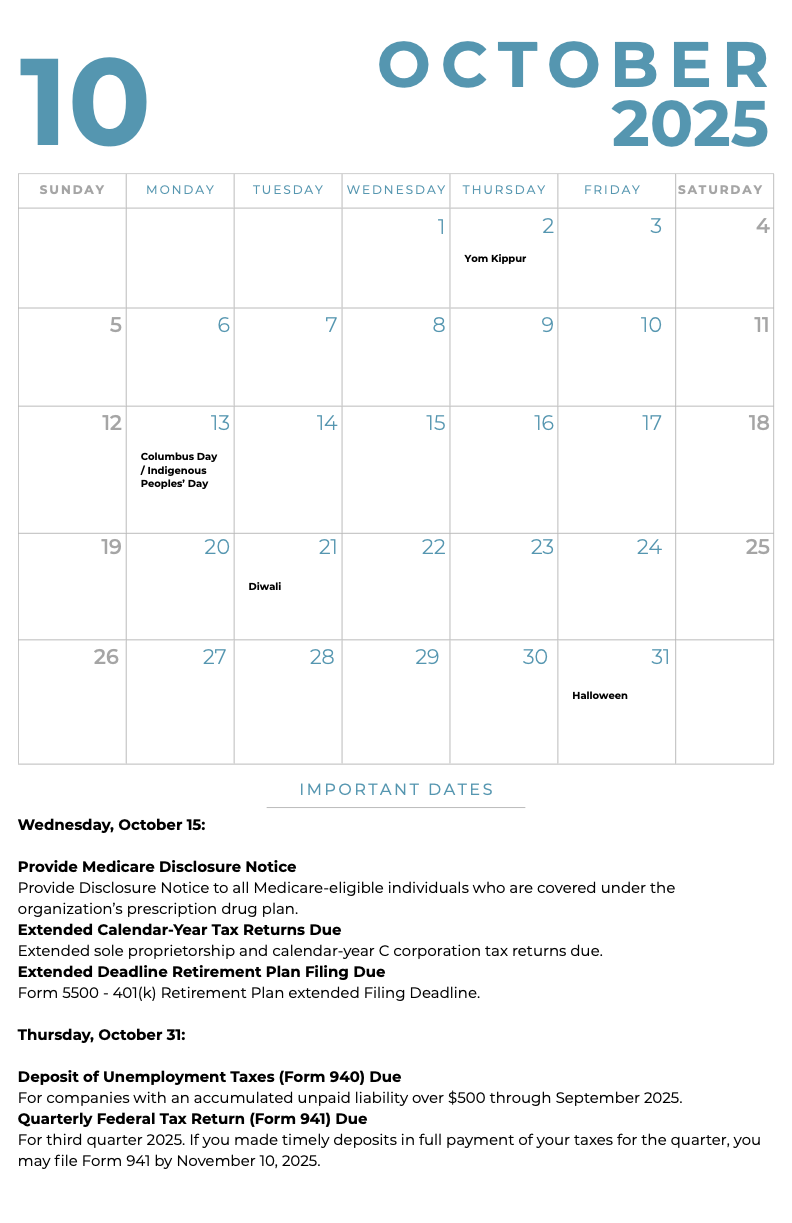

August 2025 Calendar

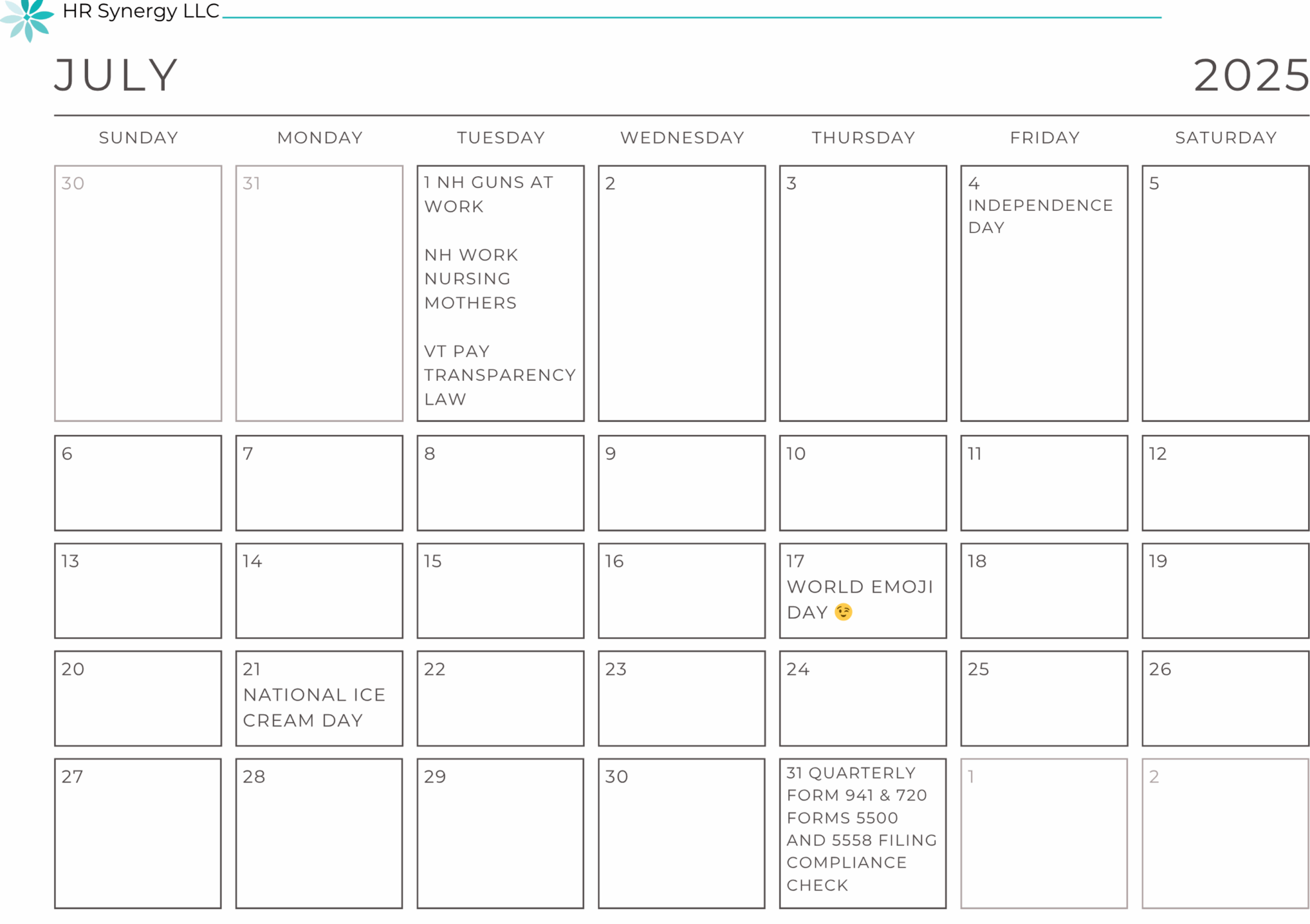

July 2025 Calendar

July Calendar

July Calendar

May is Picnic Month, National Recreation and Parks Month and National Grilling Month.

| July 1 | NH Guns at work effective |

| July 1 | NH Workplace Accommodations for Nursing Mothers |

| July 1 | VT Pay Transparency Law |

| July 4 | Independence Day |

| July 17 | World Emoji Day |

| July 21 | National Ice Cream Day |

| July 31 | Quarterly Form 941 & 720 due |

| July 31 | Forms 5500 and 5558 Filing Deadline (for calendar year plans) |

| July 31 | Compliance Check (this is time to review benefits, notices, or issued as required) |

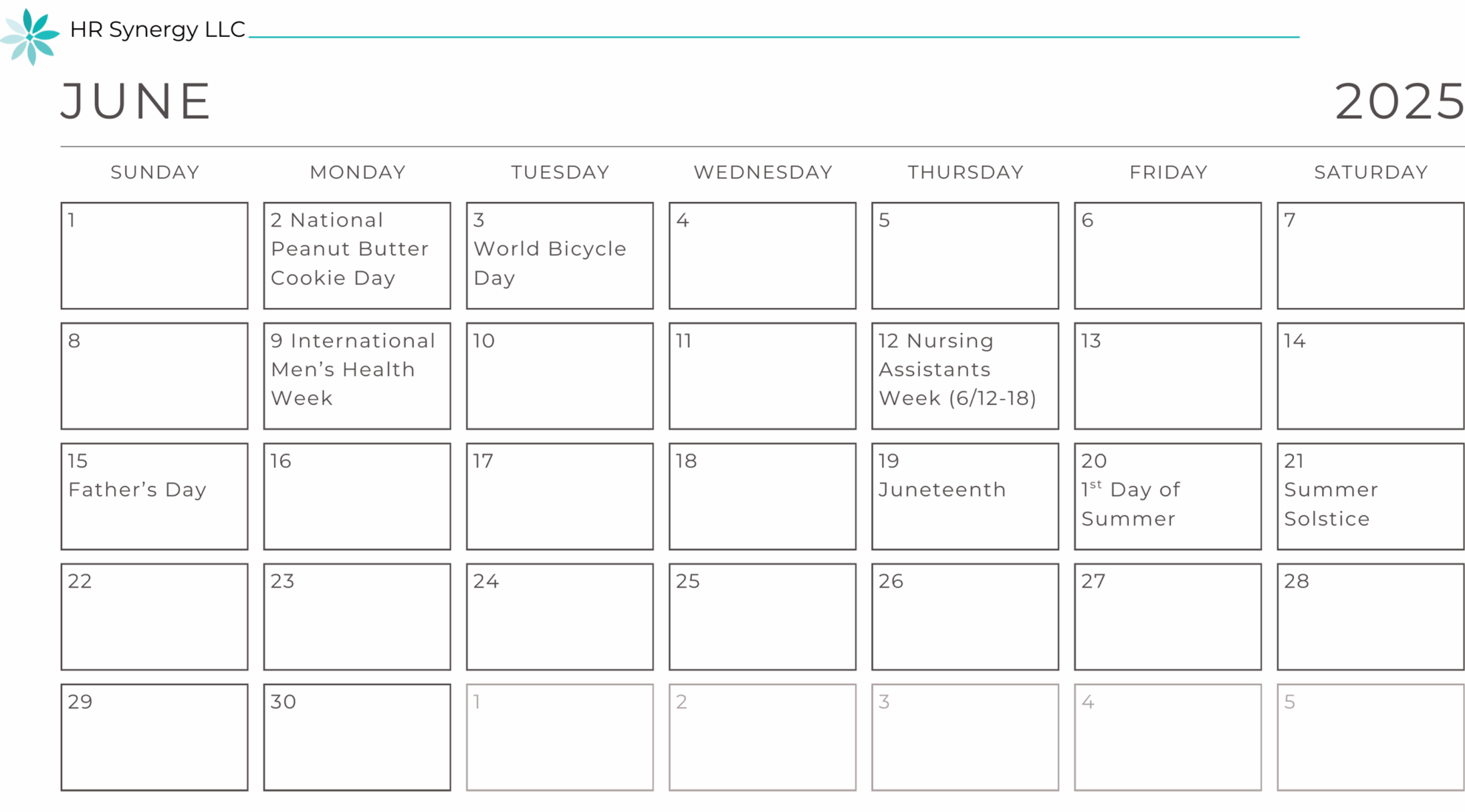

June 2025 Calendar

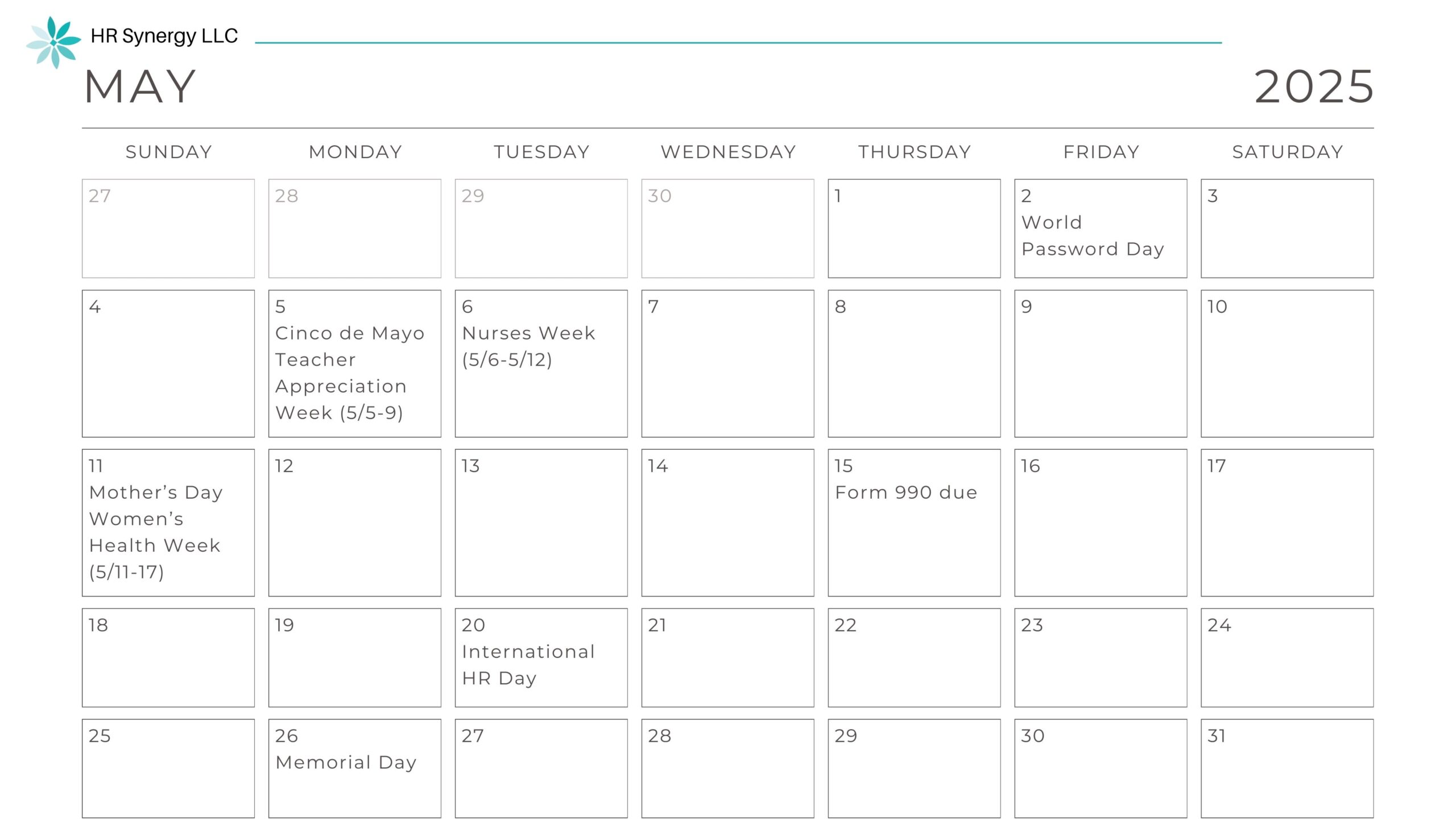

May 2025 Calendar

May Calendar

May Calendar

May is Mental Health Month.

| May 2 | World Password Day (*Remind employees to change and use strong passwords.) |

| May 5 | Cinco De Mayo |

| May 5-9 | Teacher Appreciation Week |

| May 6-12 | Nurses Week |

| May 11 | Mother’s Day |

| May 11-17 | National Women’s Health Week |

| May 15 | Form 990 is due |

| May 20 | International HR Day |

| May 26 | Memorial Day |

Client Alert: 2025 EEOC and Justice Department Warn Against Unlawful DEI-Related Discrimination

EEOC and Justice Department Warn Against Unlawful DEI-Related Discrimination

March 19, 2025: Employers’ DEI Policies, Programs, and Practices Can Violate Title VII of the Civil Rights Act of 1964. Read more.