BY 12/15/24: General HIRD reporting requirements

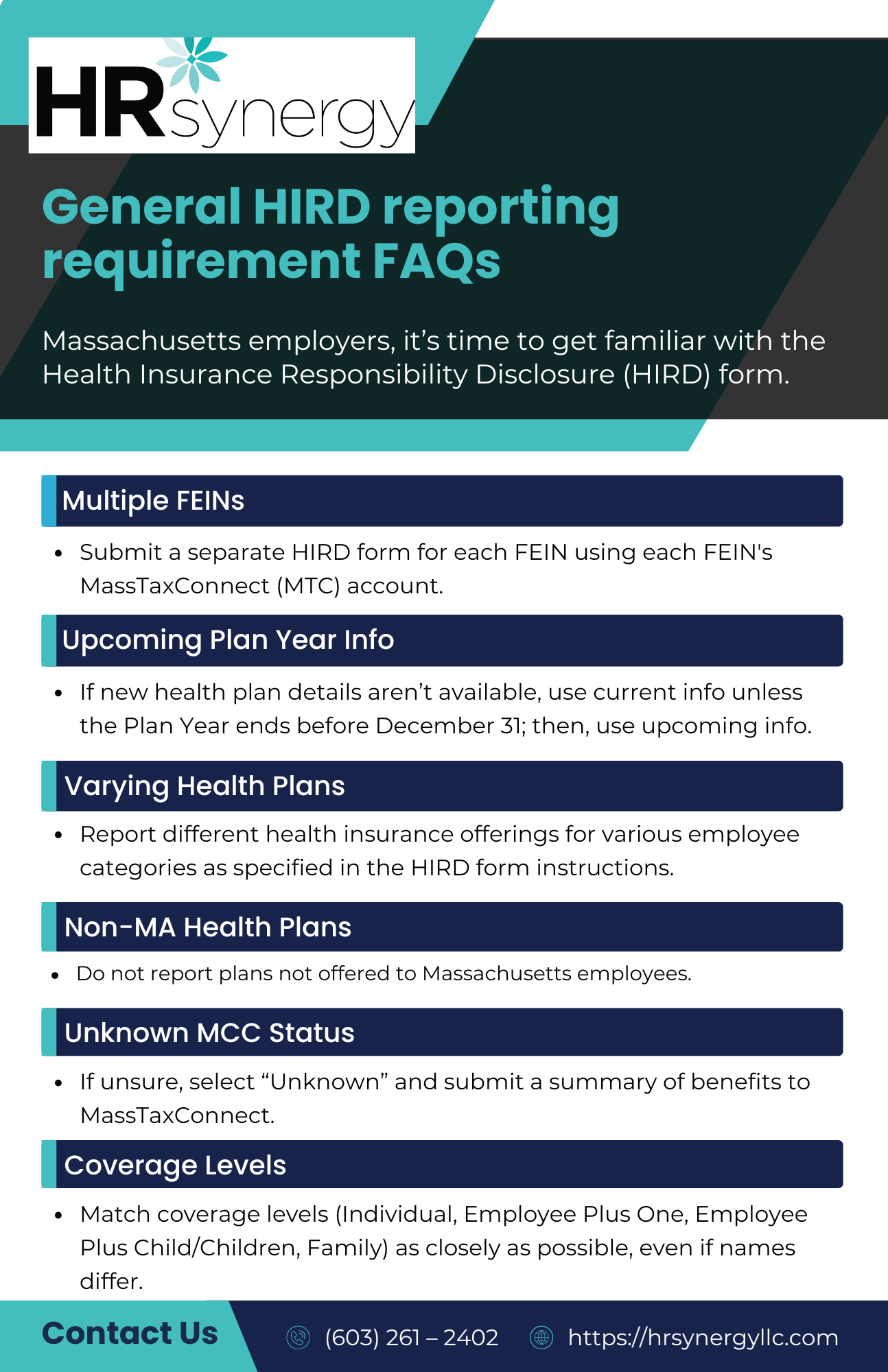

Massachusetts employers, it’s time to get familiar with the Health Insurance Responsibility Disclosure (HIRD) form. This annual requirement, launched in 2018, helps MassHealth identify members who might qualify for the Premium Assistance Program by gathering information about employer-sponsored insurance (ESI) offerings. Here’s a quick breakdown to keep you compliant.

Massachusetts employers, it’s time to get familiar with the Health Insurance Responsibility Disclosure (HIRD) form. This annual requirement, launched in 2018, helps MassHealth identify members who might qualify for the Premium Assistance Program by gathering information about employer-sponsored insurance (ESI) offerings. Here’s a quick breakdown to keep you compliant.

HIRD Form Purpose: Annual reporting requirement for Massachusetts employers to provide information on employer-sponsored insurance (ESI) offerings, aiding MassHealth’s Premium Assistance Program.

Who Must File: Employers with six or more employees in Massachusetts, even if health insurance isn’t offered.

Filing Period: November 15 to December 15, completed electronically via MassTaxConnect (no paper forms).

Responsibility: Employers must ensure timely filing, even if using a payroll company or PEO. Coordination with HR/benefits is necessary.

Data Collected: Employer-level health plan information only, no personal employee data.

Non-Compliance Impact: No new penalties, but important for MassHealth assistance programs and won’t affect EMAC Supplement obligations.

Action Required for Non-Offering Employers: Still required to submit, indicating no health insurance is provided.