December 2024: How Should Employers Respond Now that OVERTIME RULE Is Blocked?

A Federal court decision on November 15 blocked planned increases to the salary threshold for overtime exemptions.

The salary threshold will return to the 2019 level of $35,568 annually ($684.00 per week), halting increases scheduled for July 2024 ($43,880) and January 2025 ($58,656).

The court criticized the increases for exceeding statutory authority and prioritizing salary thresholds over the duties test. The ruling applies nationwide and nullifies automatic salary threshold adjustments.

- Employers who increased salaries in preparation for the new rule are unlikely to lower them. However, some employees who were reclassified as nonexempt might be switched back to exempt if they fulfill the duties test.

- The duties test remains a key determinant for white-collar exemptions, requiring assessment of job roles alongside salary.

- The ruling may be appealed, and changes could occur under the incoming presidential administration.

- Employers must assess workforce impacts and comply with duties tests and state notice requirements when reclassifying employees.

- Duties tests outline specific criteria for executive, administrative, and professional exemptions, ensuring roles meet both duties and salary standards.

APRIL 23, 2024: OVERTIME RULE

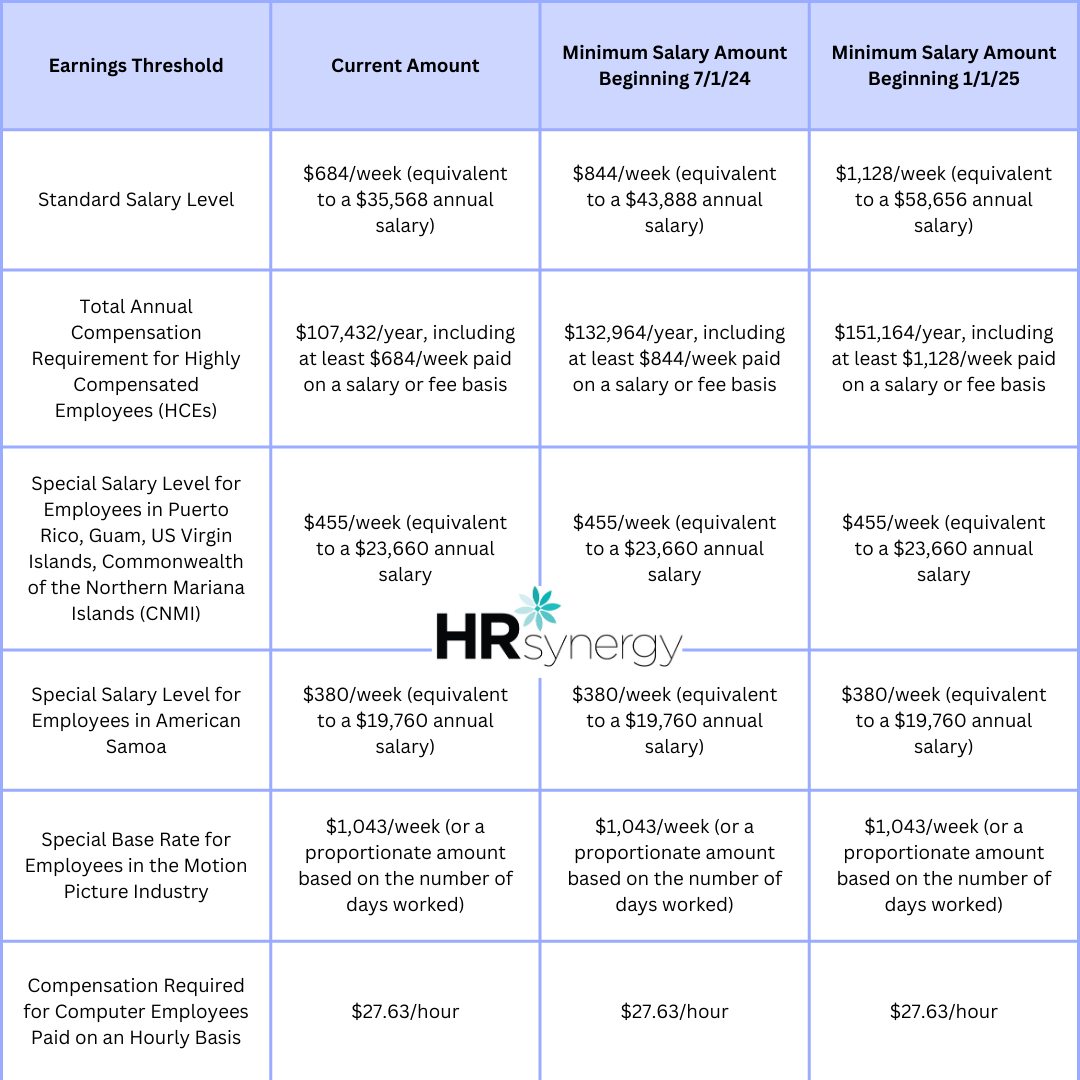

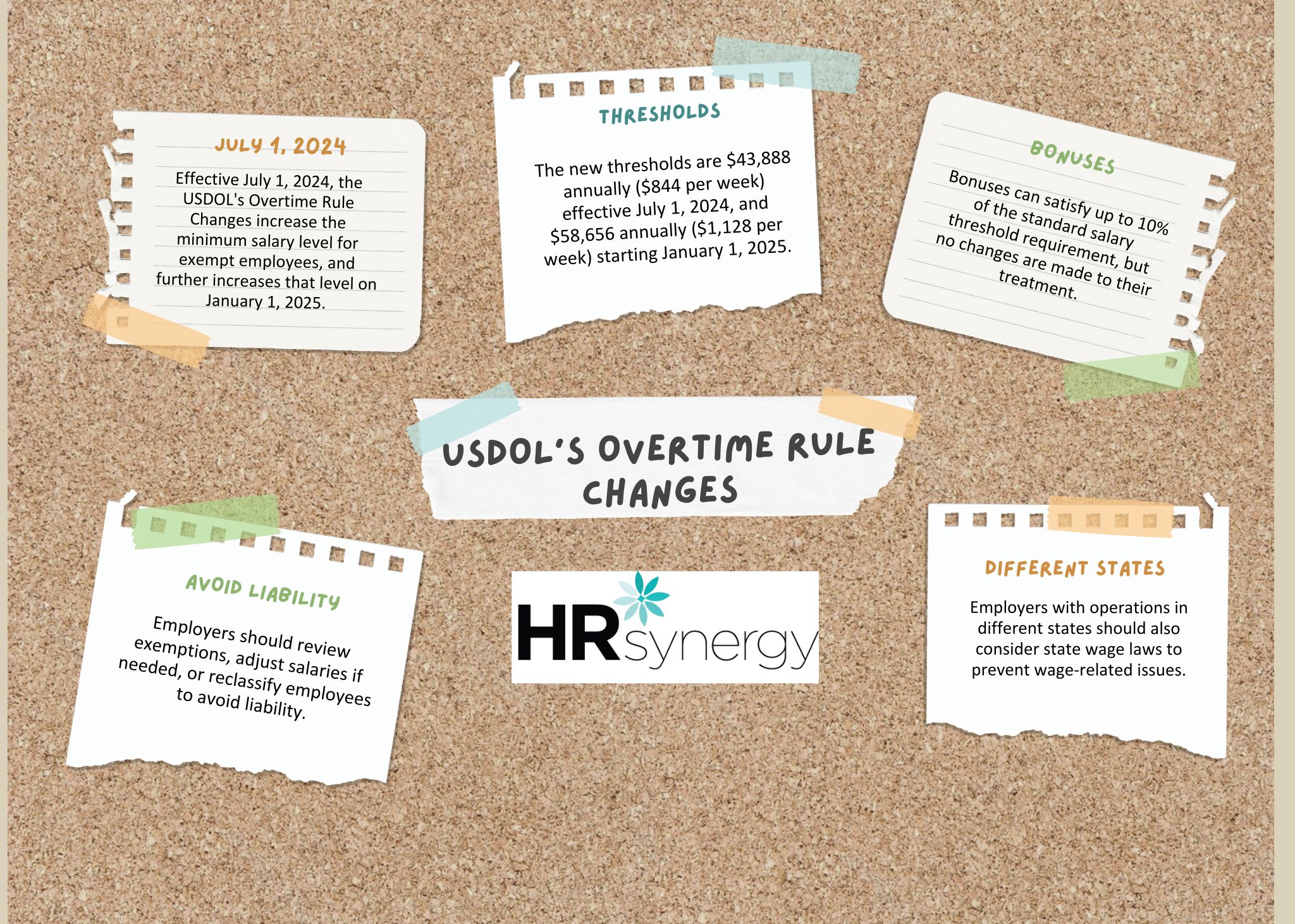

On April 23, 2024, the USDOL issued a Final Rule that will raise the minimum salary level for exempt employees and increase the total compensation minimum for highly compensated employees (HCEs). The new rule also introduces a mechanism to update these thresholds every three years. Despite potential legal challenges that may delay implementation, employers should review and adjust current salaries to ensure compliance with the new minimums.

On April 23, 2024, the USDOL issued a Final Rule that will raise the minimum salary level for exempt employees and increase the total compensation minimum for highly compensated employees (HCEs). The new rule also introduces a mechanism to update these thresholds every three years. Despite potential legal challenges that may delay implementation, employers should review and adjust current salaries to ensure compliance with the new minimums.

The rule’s journey began in Fall 2023 when the USDOL proposed changes to the federal wage law overtime exemption requirements. These proposed changes were open for public comment until November 8, 2023. During the comment period, concerns were raised about the substantial 65% increase and its impact on businesses during a tough economic period. To ease the transition, the USDOL adopted a two-step compliance approach, raising salary thresholds on July 1, 2024, and January 1, 2025.

The USDOL estimates that about 1 million currently exempt workers earn below the new $43,888 threshold and another 3 million earn less than $58,656. Employers must either raise salaries to meet the new minimum levels or reclassify these employees as non-exempt and eligible for overtime pay. While legal challenges are anticipated, similar to those in 2016, the outcome is uncertain. Therefore, employers should review current exemptions to avoid potential misclassification liabilities.

Employers should ensure exempt employees are paid at least the current minimum salary and that their job duties align with the exempt categories. For those who do not meet the duties test or new salary levels, employers need to confirm work schedules, communicate overtime eligibility, and review timekeeping, meal break, and overtime approval policies. Additionally, managers and supervisors should be trained on monitoring work hours and timekeeping.

Employers operating in multiple states should also consider varying state wage laws, which may have higher minimum salaries for overtime-exempt employees, to avoid unfavorable wage audits or claims. Compliance with both the FLSA Final Rule and state laws is crucial for reducing legal risks.