As Q1 unfolds, small businesses face mounting HR challenges. AI adoption, compliance complexity, workforce flexibility, and nonprofit funding cuts that ripple into employee support systems.

Instead of trying to juggle these internally, partnering with an outsourced HR consulting firm like HR Synergy ensures expertise, compliance, and strategic alignment without adding overhead.

Why Outsourced HR Consulting?

- Expertise on Demand: Stay ahead of evolving laws, pay transparency rules, and retirement plan mandates without hiring a full-time HR team.

- Cost Efficiency: Access senior-level HR guidance at a fraction of the cost of an internal department.

- Risk Mitigation: Avoid costly compliance mistakes and cybersecurity gaps with proactive audits and policies.

- Scalable Solutions: From AI readiness to skills-based hiring frameworks, outsourced HR adapts as your business grows.

Top Priorities We Handle for You

- AI Governance & Pilot Programs: We help you safely integrate AI tools for recruiting, payroll, and analytics while ensuring bias checks and compliance.

- Skills-First Job Architecture: We redesign job descriptions and career paths to attract and retain talent.

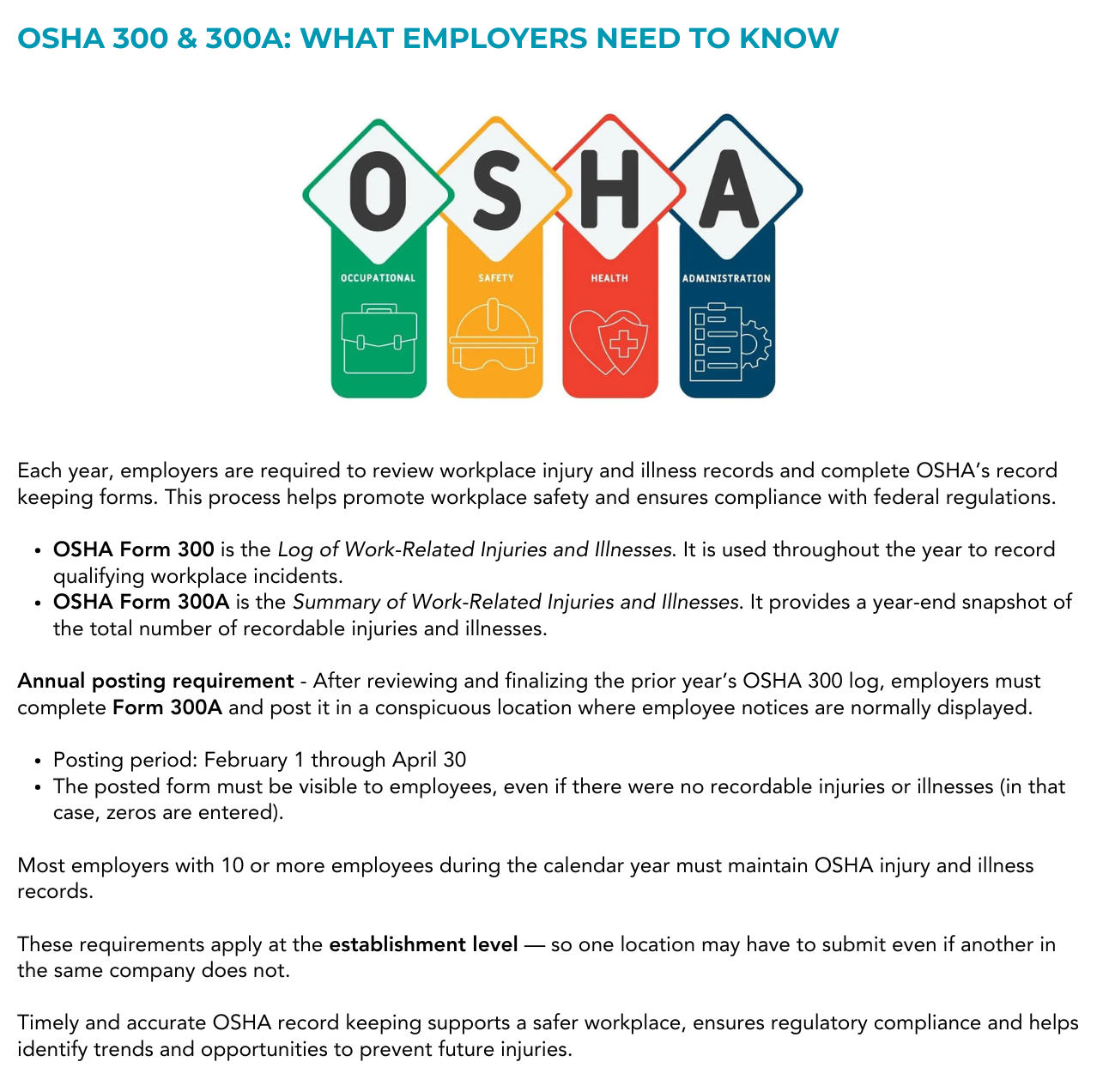

- Compliance & Pay Transparency Audits: We keep you compliant federal and state employment regulations, remote work employment tax rules, and posting requirements.

- Cybersecurity & Data Privacy Protocols: We partner with IT firms that can help protect your company and implement vendor risk safeguards.

- Workforce Flexibility & Well-Being Strategies: We craft hybrid policies and manager training programs.

- Nonprofit Funding Impact Planning: We help you navigate workforce support challenges caused by government funding cuts.

Why Act Now?

February is the perfect time to outsource HR and set your business up for success before compliance deadlines and workforce trends catch up. HR Synergy offers:

- HR Audits & Compliance Reviews

- Manager Training & Employee Communication Tools

- Compensation Analysis & Handbook Updates

- HR At Your Service Packages for Ongoing Support

Ready to simplify HR and focus on growth? Contact HR Synergy today for a consultation and discover how outsourcing HR can save you time, reduce risk, and strengthen your workforce.

Beginning January 1, 2026, New Hampshire will require covered employers to offer unpaid parental leave for certain birth- and infant-related medical appointments.

Beginning January 1, 2026, New Hampshire will require covered employers to offer unpaid parental leave for certain birth- and infant-related medical appointments.