With Valentine’s Day quickly approaching, we’ll give you things to consider before you ask your coworker to be your secret valentine. And if you still have questions, reach out to schedule your harassment training!

Our training covers:

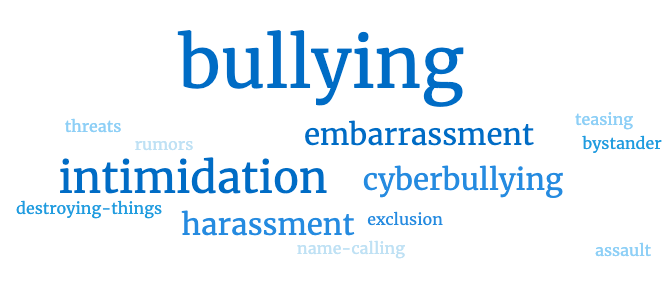

-Define the differences between bullying and harassment.

-Discuss the different types of behavior in each.

-Why is it important to prevent harassment in the workplace?

-Who’s responsible?

-Company’s policy and complaint process.

-Retaliation (illegal and more than half of all charges filed in fiscal year 2021 included a retaliation claim)

Do you know the difference between bullying and harassment?

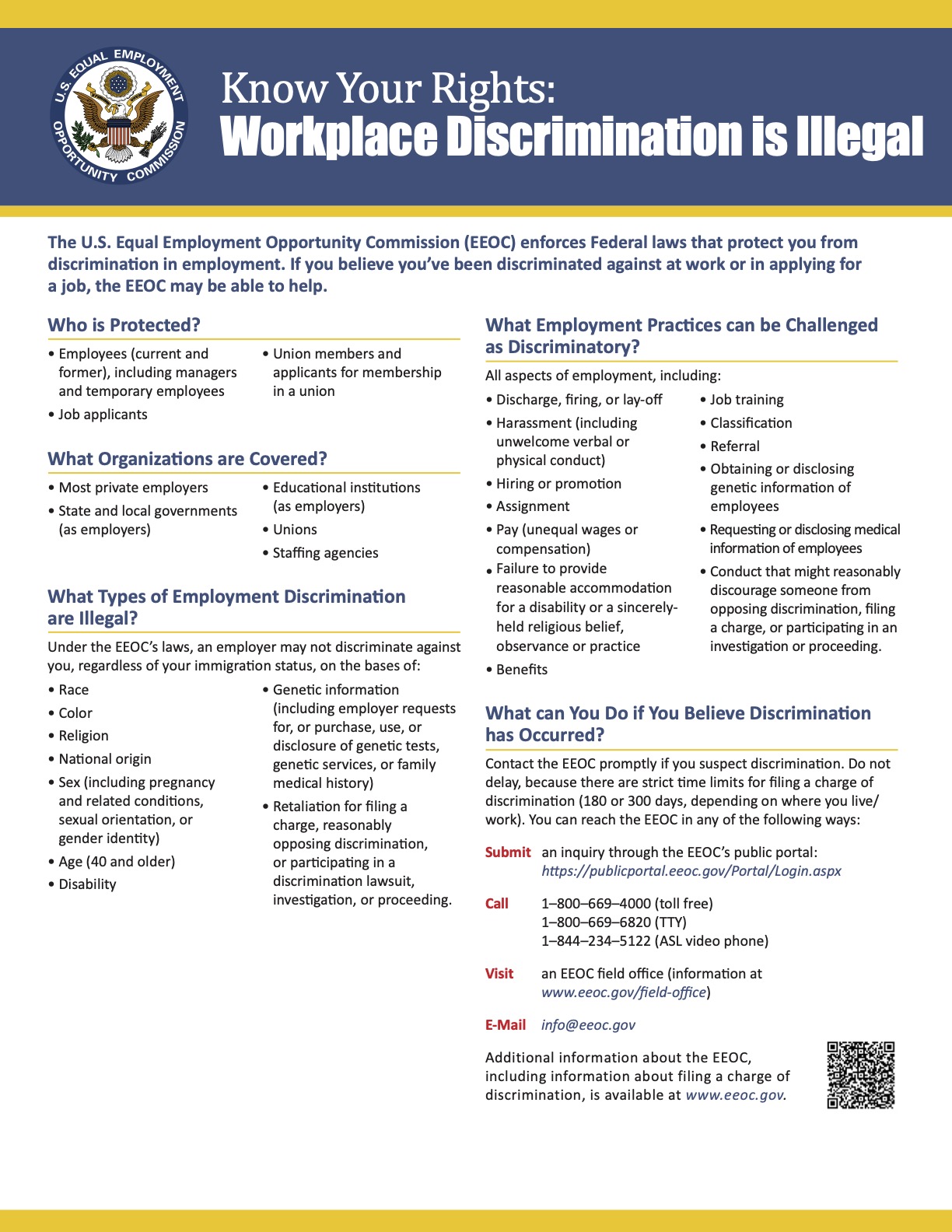

Sexual harassment is “unwelcome sexual advances, requests for sexual favors, and other verbal or physical conduct of a sexual nature in which submission to or rejection of such conduct explicitly or implicitly affects an individual’s work or school.” There are 2 types of sexual harassment. Quid pro quo occurs when a supervisor causes an employee to believe that they must submit to unwelcome sexual conduct in order to get a promotion or something else desirable at work. The second type of sexual harassment is creating a hostile environment. This occurs when unwelcome sexually harassing conduct is so severe, persistent, or pervasive that it affects an employee’s ability to participate in or benefit from a program or activity, or creates an intimidating, threatening or abusive work environment. Harassment can come in the form of verbal, non-verbal, physical, innocent/unintentional pressure. Can you and your employees recognize harassment?

Employees are responsible for creating a work environment free of bullying and harassment. You should eliminate harassing behavior such as demeaning, embarrassing, or offensive conduct. If you experience harassment, immediately report it to one of the persons indicated in your company’s non-harassment policy. Remember that retaliation is strictly prohibited.

Employers are responsible for creating and distributing a company policy and complaint procedure regarding bullying and harassment. Do you need help creating these? Contact us.

Retaliation is “an adverse action taken against an employee because he or she complained of harassment or discrimination or participated in an investigation” and is prohibited by anti-discrimination laws. Retaliation is any adverse action including demotion, discipline, termination, salary reduction, negative performance appraisal, change in job duties or shift assignment. More than half of all charges filed in fiscal year 2021 included a retaliation claim. Be sure you are compliant with anti-discrimination laws and contact us for support.