Compliance Tips for Avoiding Common FMLA Violations

Navigating the Family and Medical Leave Act (FMLA) can be complex, especially when handling intermittent or reduced-schedule leaves.

Employers frequently make mistakes that lead to compliance violations:

- Failing to provide required notices

- Improperly tracking absences

- Penalizing employees for FMLA-protected leave

- Requesting excessive medical documentation

Many of these errors stem from inadequate manager training and failure to recognize FMLA-qualifying leave requests.

Key Compliance Strategies:

- Understand FMLA Regulations – Employers should thoroughly review FMLA guidelines and post required notices.

- Post the FMLA poster – Download the poster from the U.S. Department of Labor (DOL) Wage and Hour Division website.

- Create the required FMLA forms – These forms include eligibility notice, rights and responsibilities notice, designation, medical and military certification forms. The forms from the DOL Wage and Hour Division can be customized with restrictions.

- Develop a Clear Policy – A well-defined company policy should outline FMLA administration, including leave calculation methods and responsible personnel.

- Process requests – Process in compliance with FMLA regulations, relevant laws, and company policies.

- Train Managers Regularly – Supervisors should be educated on how to handle FMLA leave requests, recognize protected absences, and avoid retaliation.

Employers who implement structured FMLA procedures and provide ongoing training can minimize compliance risks while fostering a supportive workplace.

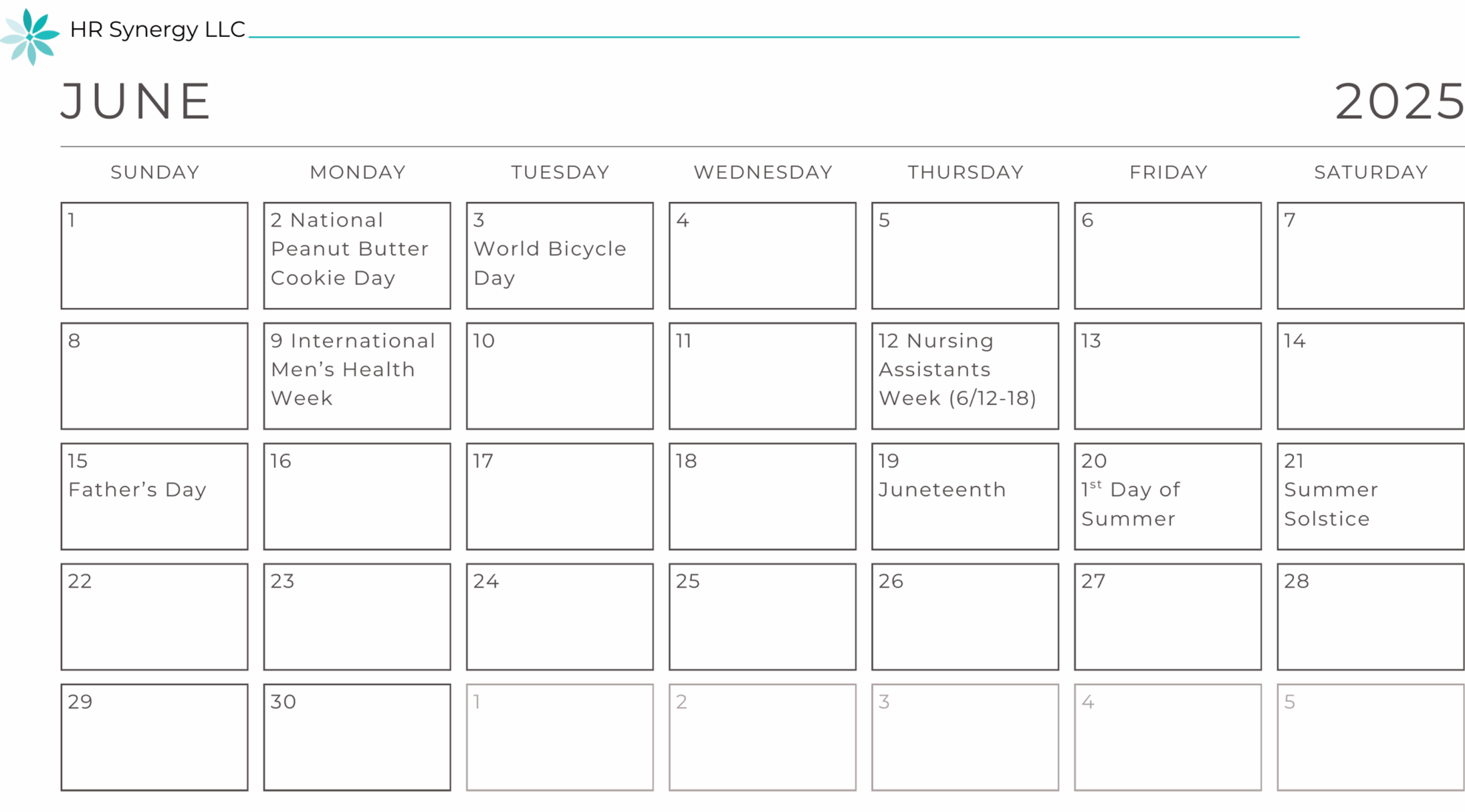

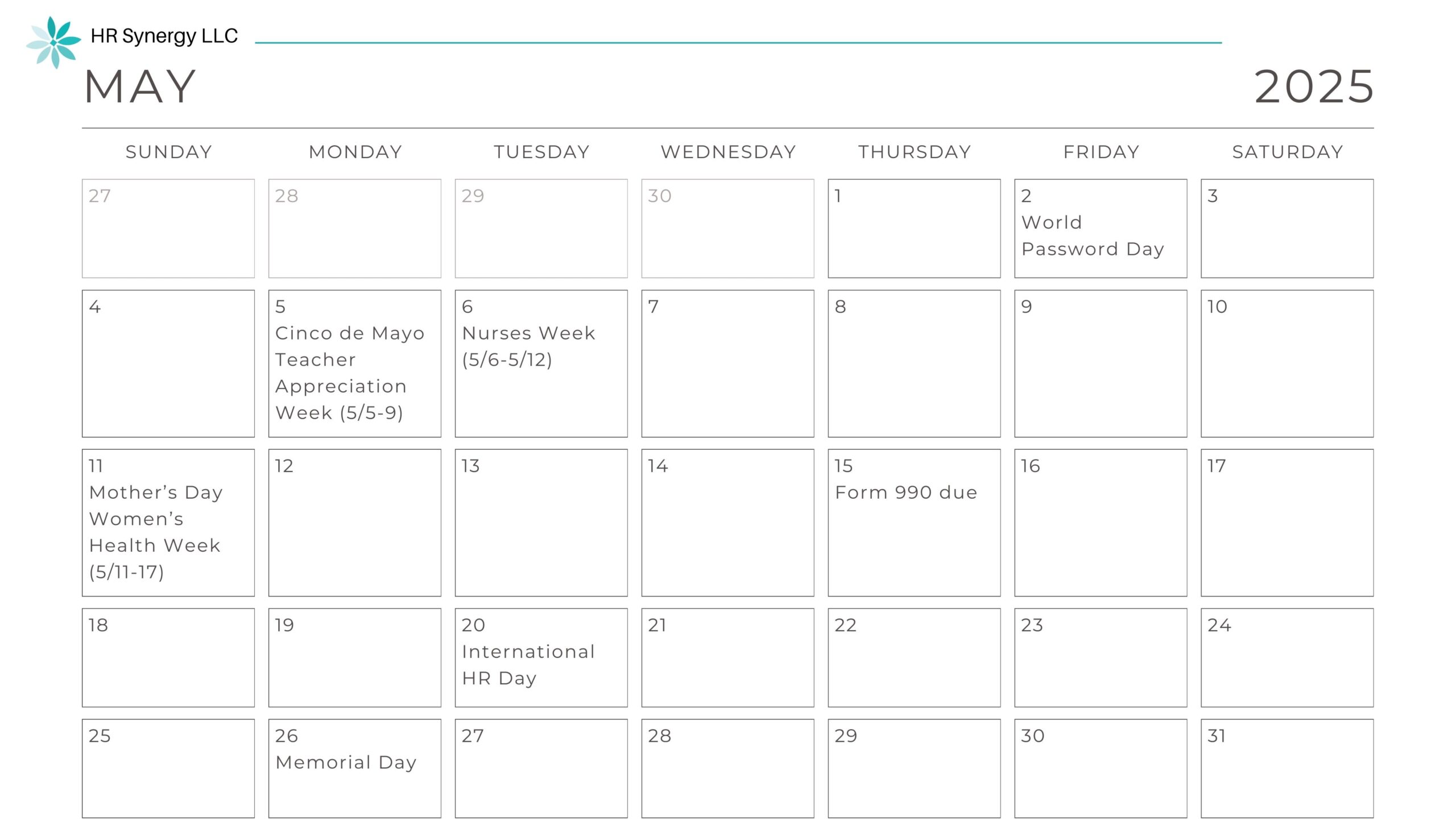

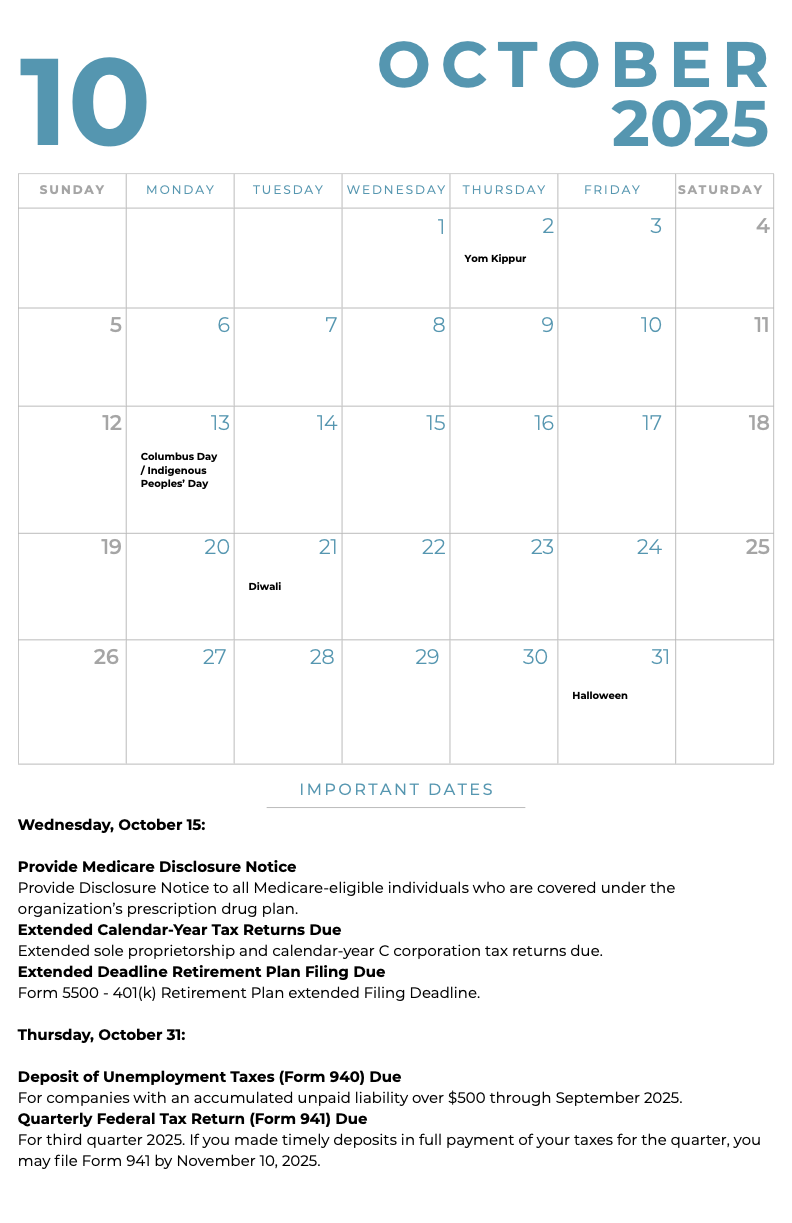

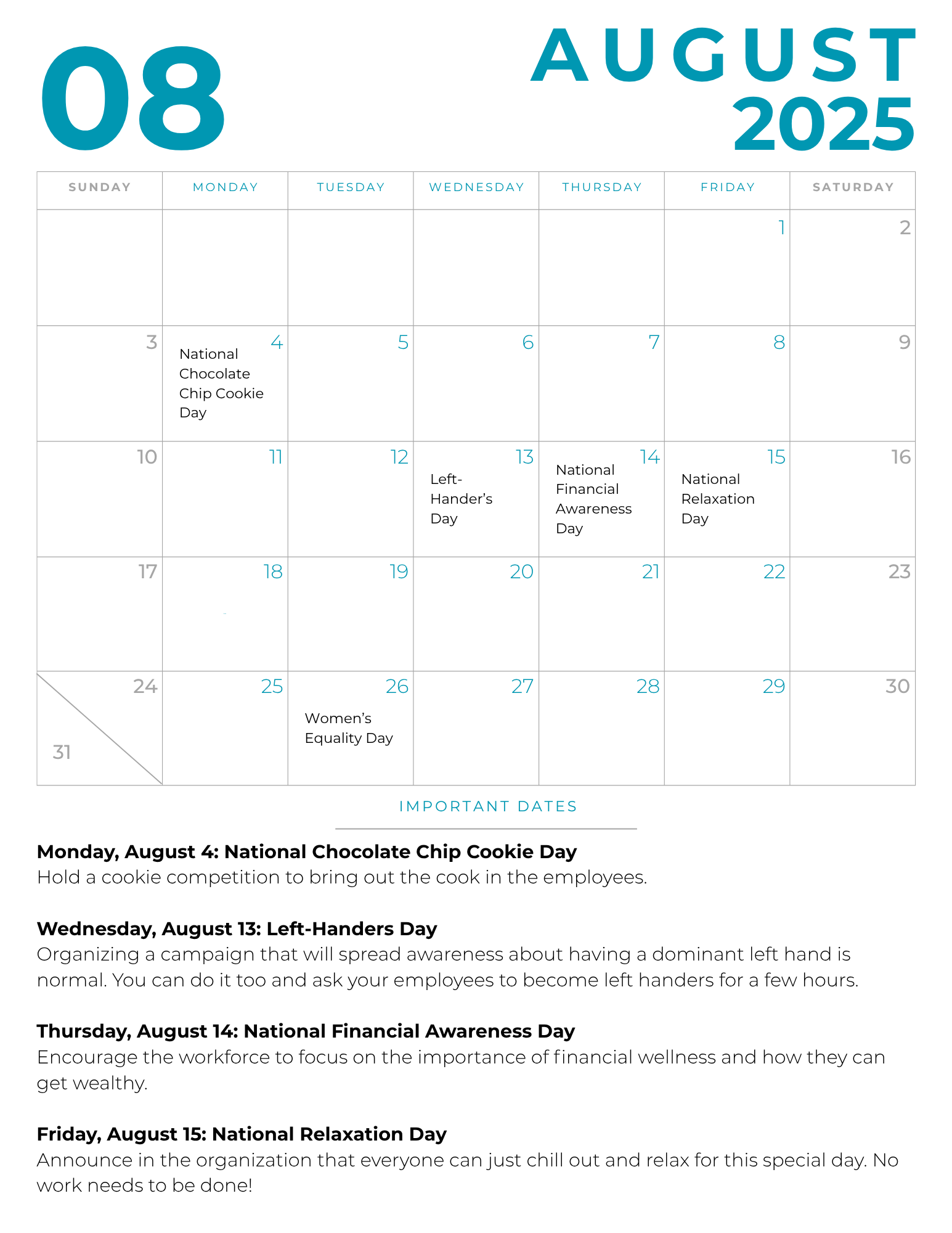

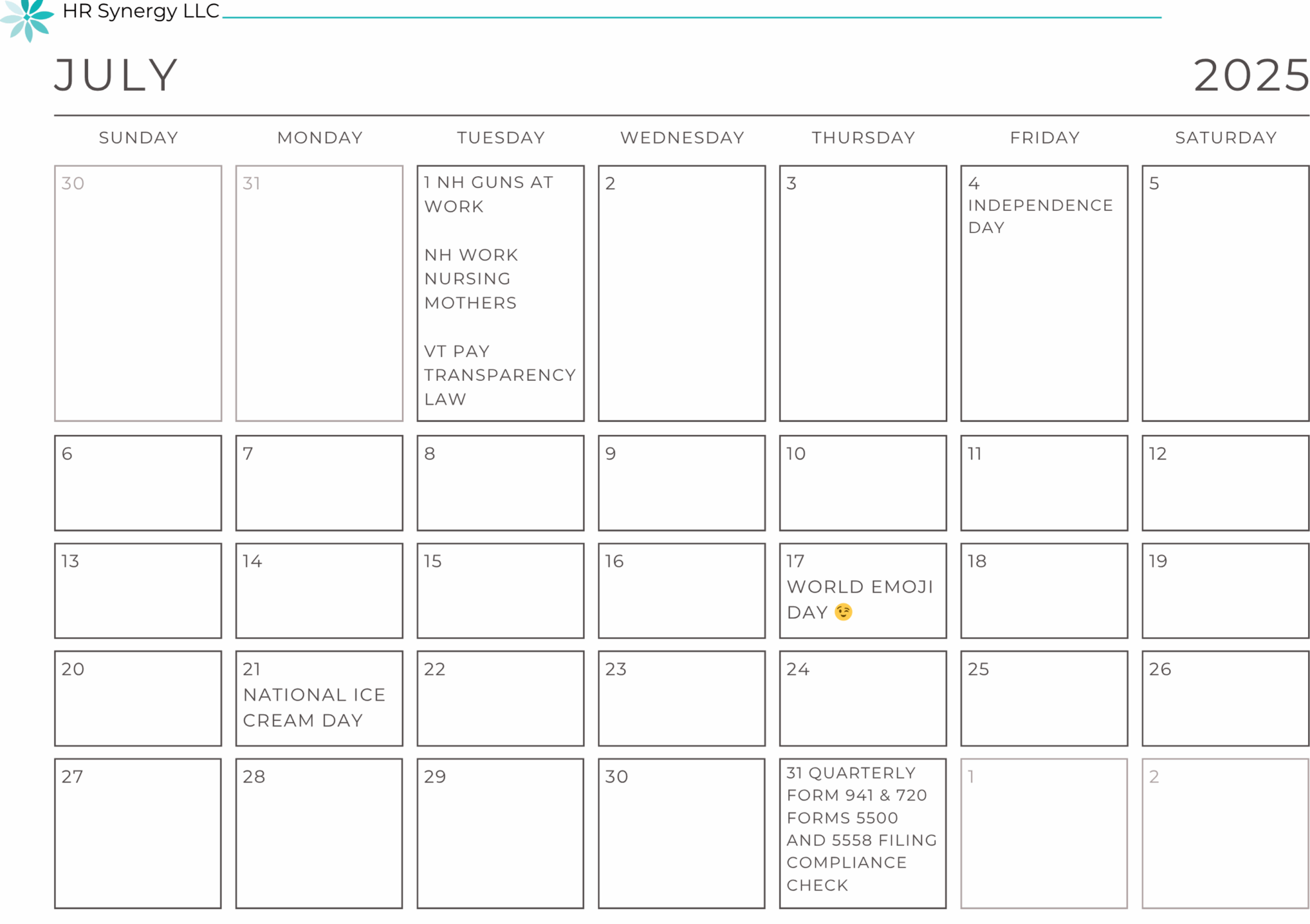

July Calendar

July Calendar